Payback time for PWLB

The Public Works Loan Board generated just over £2.8bn in interest income on its loans in 2017-18, its annual report has shown. It also collected more than 30,000 interest and loan repayments, and collected interest payments on over 15,000 loans with a carrying value of £70.8bn.

LGPS: 5 million and counting

There were 5.6 million people in the Local Government Pension Scheme in England and Wales at the end of March 2017, according to government statistics. Of these, 2 million were employees still contributing, 1.6 million were pensioners and 2 million former employees entitled to a pension in the future.

In line with the actuaries

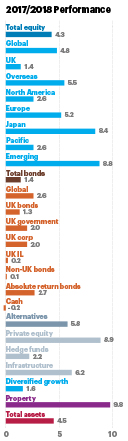

The average local authority pension fund has returned about 4.5% over the past 12 months, according to the Pension & Investment Research Consultants annual report on the LGPS. This is below the 30-year average of 8.9%, but broadly in line with actuarial assumptions of 4%.

Funds still seek active value

There has been a decline in the number of funds managed actively, from 90% to 74% over the past decade, the PIRC annual report noted. However, at almost three-quarters of total assets, the proportion of actively managed funds remains high. “Although funds are focused on reducing costs, the move from (high-cost) active management to (low-cost) passive is not gaining significant ground as most funds continue to seek active value over and above the active managers’ fees,” the report stated.

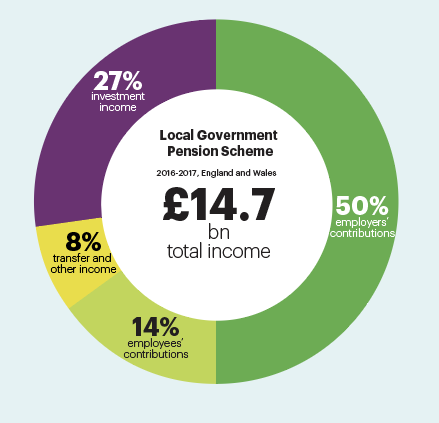

Scheme by numbers [right]

Scheme by numbers [right]

LGPS income in 2016-17 was £14.7bn, of which 27% was supplied by investment income, Ministry of Housing, Communities & Local Government statistics show. Employer contributions made up half of the scheme’s income, while employees contributed 14%. LGPS expenditure in 2016-17 was £11.8bn, equivalent to 81% of income.

LGPS income [left]

While the average return on LGPS assets was 4.5% in 2017-18, the PIRC annual report said asset returns were tightly grouped, with bonds, equities and alternatives returning 1%, 4%, and 6% respectively. There was wider variation within asset classes than between them. Emerging market equities returned an average of 9%, while UK equities delivered just 1%. Property returned almost 10% and private equity 9%.

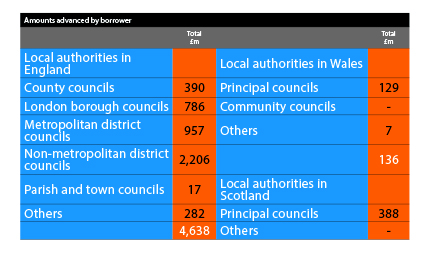

PWLB: money out…

The Public Works Loan Board approved local authority loans of almost £5.2bn in 2017-18, according to its annual report. Of this, £4.6bn went to English councils, £388m to councils in Scotland and £136m to those in Wales. Among English councils, non-metropolitan districts borrowed the most at £2.2bn, followed by metropolitan districts at £957m. English counties sought just £390m from the PWLB, while London boroughs secured £786m in PWLB loan finance.

…and money back in

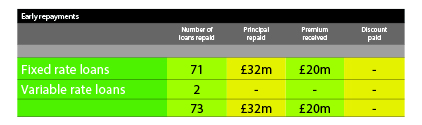

The PWLB received early repayments of £32m in 2017-18, compared with £55m the year before. A total of 73 loans were repaid, of which 71 were fixed-rate and two variable rate. The value of loan principal outstanding to borrowers rose by 5.3% to £70bn, up from £66.6bn at the end of 2016-17, the annual report said. It also noted there was less than £1m in overdue loan repayments at 31 March 2018, and all of these have since been paid.

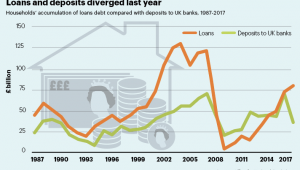

High before a low?

The Bank of England’s Monetary Policy Committee voted unanimously to increase base rate to 0.75% in August, up from 0.5%, where it had been since November 2017.

The MPC took the view that the economy had recovered sufficiently since the ‘Beast from the East’ cold snap that affected the country last winter.

However, Bank of England governor Mark Carney indicated that rates could be cut again to deal with the fall out from a “disorderly” Brexit:. “We can adjust when necessary,” he said.

Interest rates have plummeted since the global financial crisis and have been at historic lows since 2009.

The Bank of England base rate was at its lowest-ever level of 0.25% between August 2016 and November 2017.

According to Bank of England historic data, interest rates were highest in 1979 when they hit 17%. Interest rate data goes back to 1694, when the rate was 6%.