The WGA for 2014-15 published today revealed that the public sector net liability had passed £2,000bn, and the NAO's examination stated said the quality and accuracy in the sixth set of accounts was continuing to improve.

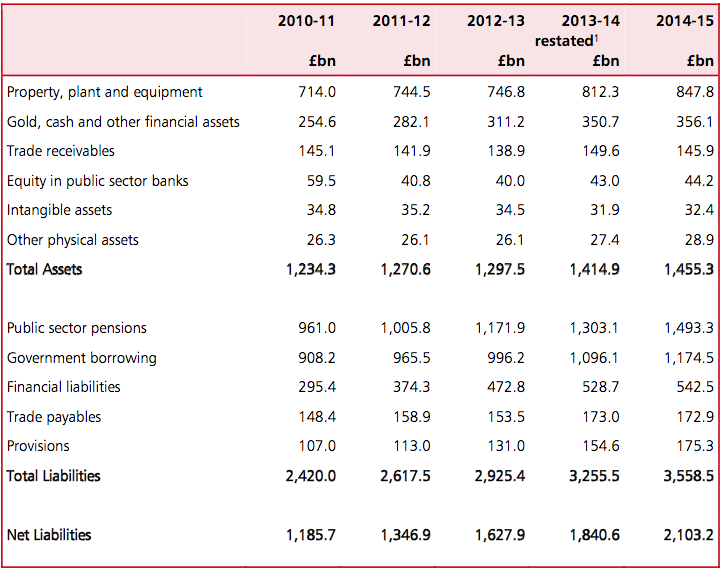

According to the report, total public sector assets in 2014-15 stood at £1,455.3bn, while there were total liabilities of £3,558.5bn. As a result, public sector net liabilities stand at £2,103.2bn in 2014-15, up 14.3% from £1,840.6bn in 2013-14.

Image: Treasury

This has mainly been due to increases in unfunded public sector pension liabilities, which increased by £190.2bn (+14.6%) during 2014-15, mainly due to a reduction to the discount rates used to measure the liability. This has been reduced to reflect changes in the real yield on corporate bonds, and due to the long-term nature of the liability such changes can have a large impact. Liabilities related to government borrowing also increased by £78.4bn.

Auditor general Sir Amyas Morse has continued to qualify his opinion on the accounts owing to the scope of the WGA. For example, he highlighted that significant bodies such as the Royal Bank of Scotland are not included in the accounts. And although the accounts now include Network Rail and the Pension Protection Fund, the valuation of infrastructure assets such as the local authority road network and the rail network is yet to be aligned with the rest of the government’s assets.

However, two qualifications have been removed since the 2013-14 accounts, relating to third and fourth generation mobile phone licensing income and the accuracy of the reflection of schools assets.

The remaining qualifications are being addressed and there is a path to the removal of most of these in the coming years, the report added.

“The Treasury is improving the quality of the WGA, the completeness of information within it and its accuracy. As a result, I have been able to reduce the scale of my qualifications of the accounts this year,” Morse stated.

However, he reiterated a call for the government to make better use of the WGA for understanding the public finances.

“It provides a unique perspective because of its reach and approach to measuring the government’s financial performance and position. Better analysis by the Treasury of the nature of the assets across the government’s portfolio, the extent and sources of liabilities and the financial risks it is exposed to, will help Parliament and the public to understand better the full range of the government’s financial commitments and its approach to managing them.”

The Treasury’s process for producing the 2014-15 accounts was affected by delays to the Department for Education’s financial statements this year, today’s NAO report highlights. While improvements in the timeliness of the accounts will be crucial to the WGA’s development as a management tool, the Treasury is managing and controlling the process better.

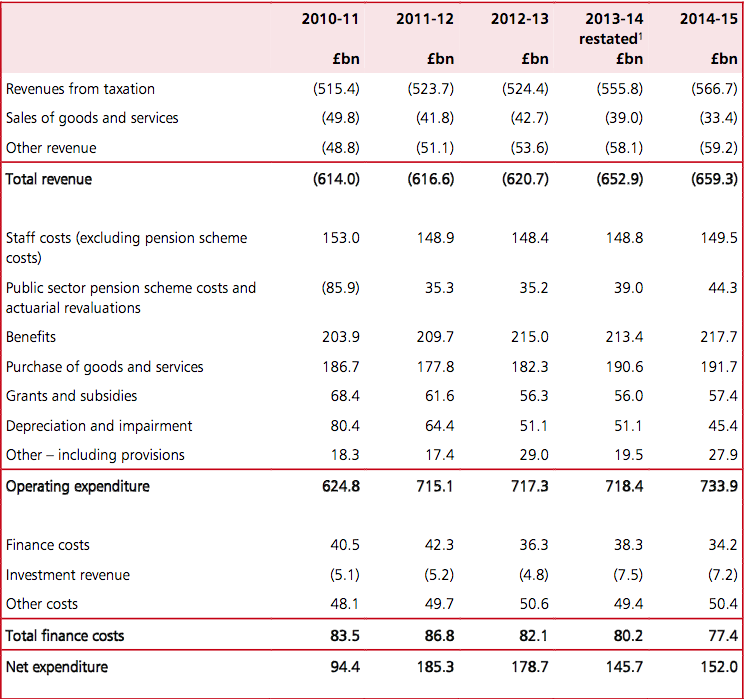

The set of accounts show that the net expenditure deficit in 2014-15 increased by £6.3bn, to £152.0bn. As well as the increase in pension scheme liabilities, this also reflects liabilities for nuclear and oil and gas field decommissioning. Within net expenditure, wages and salaries are broadly stable at £148.3bn compared to £148.2bn, in the light of staff numbers falling by 20,346.

Image: Treasury

CIPFA chief executive Rob Whiteman CIPFA said the accounts provided a basis for sound financial decision making in government, one that was unique in the world.

He observed: “This could give the UK a real competitive advantage but policy makers still prefer the inaccurate statistical methods they are used to. It’s time the Treasury brought national financial planning in to line with professional standards.

“The Whole of Government Accounts must be produced earlier to inform the Autumn Statement. Delays this year were due to a shocking lack of record keeping in academy schools which must be remedied urgently.”

Whiteman also warned that the increase in public sector pension liabilities to £1.5tn was “dangerously unsustainable” and said anyone blocking reform was likely to be contributing to the collapse of the entire system in the decades to come.