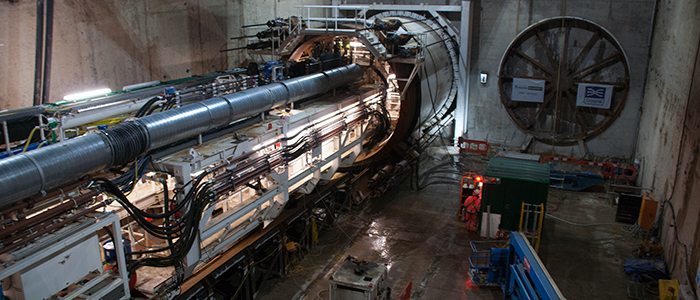

Chancellor George Osborne has called for LGPS assets to be pooled in order to create British Wealth Funds that can invest in infrastructure projects. Photo: Crossrail.

At the 2015 Conservative Party conference, chancellor George Osborne first called for the assets of the 89 Local Government Pension Scheme funds in England and Wales to be merged into six wealth funds, containing at least £25bn of scheme assets each.

Following the November Spending Review, the government told administering authorities that have to suggest initial pooling proposals by 19 February.

Public Finance understands that as many as eight pools are being developed, and senior figures said that it was not clear whether Osborne’s target remained a “hard line” or if ministers could back a larger number of smaller funds.

Among the schemes is a £35bn pool of eight LGPS schemes across the Midlands, the ACCESS (A Collaboration of Central, Eastern and Southern Shires) group of eight confirmed funds, and the common investment vehicle being developed by London boroughs. Proposals also include the £10bn asset pooling arrangement already confirmed by the London Pension Fund Authority and the Lancashire County Pension Fund.

Mark Whitby, head of pensions at the LGSS shared services group that includes Cambridgeshire and Northamptonshire, said ACCESS would meet the £25bn minimum. Confirmed members include Cambridgeshire, Essex, the Isle of Wight, Kent, Norfolk, Northamptonshire, Suffolk and West Sussex.

“Some [pools] are below the size criteria at the moment that we’re aware of – the most public example is Wales, and there is a question how that will work,” he said.

“There are potentially more than six going into the February proposals. The question is, if one pool doesn’t quite meet the size criteria, what’s going to happen to the funds within that pool? That is what we don’t know at the moment – whether that pool will be asked to merge with another one or whether it will be broken up.”

Neil Sellstrom, CIPFA’s treasury management and pensions adviser, told PF there was “still a lot to be clarified” about how the funds would function. The assets that would be included and how the new governance arrangements would be implemented were among the key questions.

“Some of the big Northern funds have big internal managed pools, which are very cost effective and have been very successful, that need to be built into this,” he highlighted. “So there’s a lot to be discussed, and CIPFA is working on a response.”

Sellstrom added the government’s submission deadline had catalysed collaboration plans that were “in different places” across the country, and the flexibility to develop local solutions was positive.

“CIPFA is supportive of the government’s plans – there is a lot of good practice already and we welcome opportunity for this to be shared,” he said.

The pools being developed are: a Northern Powerhouse pool, the Midlands pool, ACCESS, the London CIV, a South West pool, one covering Welsh LGPS funds, and a scheme called “Border to Coast”, as well as the LPFA/Lancashire arrangement.