Council tax should be replaced by a levy on the value of homes, a major review of UK taxation has concluded.

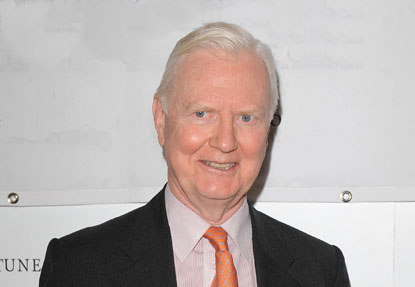

The Institute for Fiscal Studies’ today published the conclusions of its five-year long review of the UK tax system. The review, chaired by Nobel Prize winning economist Sir James Mirrlees, is the most far-reaching analysis in more than 30 years.

It finds that taxation in the UK is ‘inefficient, overly complex and frequently unfair’.

The changes to housing taxation aim to resolve the ‘mess’ of the current system of council tax, IFS director Paul Johnson said. He said that the fact that council tax valuations in England were based on property values 20 years ago made the current system ‘unnecessarily regressive’.

A Housing Services Tax, charged as a percentage of the value of each property, should replace council tax, the report says.

The proposed tax forms part of a recommendation to introduce VAT on almost all spending over the long term. The current exemptions on food, children’s clothing and books and magazines made the tax ‘needlessly complex and inefficient’, the report says. To compensate for the change, income tax could be cut and benefits increased with the extra taxation raised.

The housing tax would ‘stand in place of VAT’, the review authors say. ‘If we want to tax the consumption value of housing, it is probably best to do so at the point at which the services are consumed, rather than at the point of first purchase. That suggests an annual tax related to the (consumption) value of the property.’

Asked whether the new tax should remain in local authority control, Stuart Adam, one of the report’s authors, told Public Finance that the review had ‘steered clear’ of which taxes would be levied locally or nationally. But he added that a property tax ‘looks like a good tax to be local’.

The review also proposes merging income tax and National Insurance, saying that the latter ‘no longer serves any purpose’ as a separate social insurance contribution.

It also backs the government’s plan to replace the current range of benefits with a Universal Credit. It says the benefit system is ‘unnecessarily complex’ and reduces incentives to work.

Mirrlees said the review showed the current system could be simplified and ‘raise as much revenue and achieve as much redistribution as it currently does in far less costly ways’.

He added: ‘We propose a clear long-term vision and direction of reform. While some of the reforms we recommend involve tweaks to current policy, others involve change which is radical and is for the longer term.

‘There is no getting away from the political difficulty associated with some of the proposed changes. But there is also no getting away from the enduring costs of failure to reform.’

Johnson said that the report should form the basis of a ‘long‑term, considered and systematic approach to tax policy’.

He added: ‘There is little about the UK tax system which looks like it was deliberately designed. Successive governments have failed to set out a coherent strategy for tax. As a result, the current set of taxes is complex and often incoherent and they impose a much greater cost on the economy than need be.’