Boosting bond transparency

The proportion of sovereign bonds internationally that are governed by English law, against 52% governed by New York law. British MPs have called on the US chancellor to press for a ‘registry of loans’ to governments at this month’s G20 meeting to boost transparency about how they are spent, especially in countries with debt problems.

Physician, heal thyself

The number of GP practices that have closed in the UK over the past six years as the health service deals with a workforce crisis, according to Freedom of Information Act data obtained by the GP publication, Pulse. In 2018, closures hit record levels, with 138 practices shutting.

Cash in on female intuition

The boost to businesses when they employ more women in top jobs, according to an International Labour Organization report covering 70 countries. About 60% of firms said gender diversity improved creativity, innovation and reputation and almost 75% of companies reported profit increases of up to 20%.

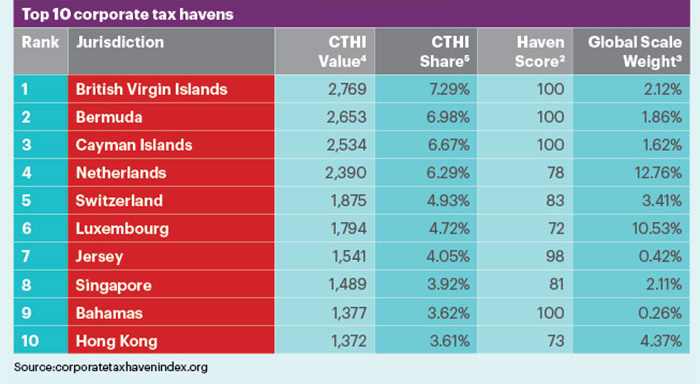

UK at heart of global tax avoidance

Tax havens luring companies engaged in cross-border trade with rock-bottom rates are destroying the global corporate tax system, says the Tax Justice Network. It claims 40% of cross-border direct investments reported by the International Monetary Fund worth $18trn are being registered in just 10 countries. It lays the blame for the damage this is causing to government revenues across the world squarely on the UK and its “controlled network of satellite jurisdictions” and a handful of other OECD states. The network’s Corporate Tax Haven Index (CTHI) indicates that a few countries have aggressively undermined the ability of governments to tax multinationals properly by offering corporate tax rates of 3% or less. It blames the top 10 offenders – including three British territories and a British dependency – for 52% of the world’s corporate tax avoidance risks.

New Zealand’s ‘landmark’

New Zealand’s Labour coalition government has hailed a “landmark moment” by unveiling a budget focused on citizen wellbeing over economic growth. It will prioritise mental health, child poverty, the environment and domestic violence, said minister of finance Grant Robertson.

“I am proud of this wellbeing budget – it is a landmark moment for this government and New Zealand,” Robertson said. The government will spend NZ$3.8bn per year on reaching targets in these areas, up from NZ$2.4bn in the 2019 budget.

Prime minister Jacinda Ardern said the budget “shows you can be both economically responsible and kind”. She added: “We are turning the corner on issues others have written off as too hard for too long – while keeping the books in order.”

Spending up: from NZ$2.4bn in 2019 to NZ$3.8bn per year

- NZ$3.5bn: the predicted 2018–19 surplus rising to NZ$6.1bn in 2022–23

- NZ$1.9bn: the record level of investment in mental health

- NZ$1bn: funds for the redevelopment of state-owned KiwiRail

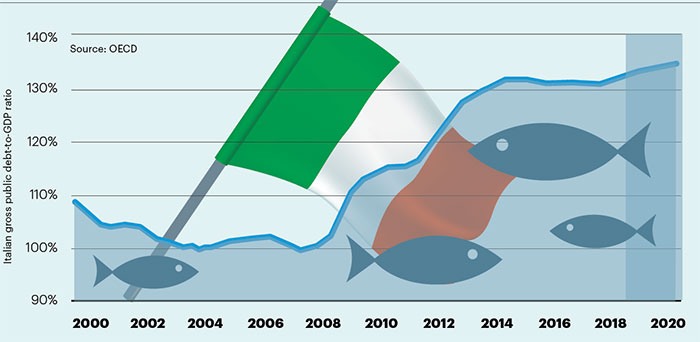

Italy faces EU fine

The EU has written to the Italian government asking it to explain a deterioration in its public finances, amid reports that Brussels is ready to launch disciplinary action against Rome. The European Commission letter is triggered when a member state with public debt above the EU ceiling of 60% of GDP fails to reduce it accordingly. Italy’s deputy prime minister and minister of the interior Matteo Salvini has told RTL radio the EC could fine his country €3bn over its rising debt and structural deficit levels. Italy’s €2.5trn debt – 132% of its GDP – is proportionally the second-highest in the eurozone after Greece, and its structural deficit is set to reach 2.4% of GDP this year and 3.6% in 2020, according to Reuters.

Councils near empty

The BBC has named 11 English councils at risk of exhausting their reserves entirely by 2024 if they continue to raid them at current rates.

Following CIPFA’s resilience index, which found 15% of councils in England at risk of financial instability, the BBC analysed government data between 2015 and 2018.

Richard Watts, chair of the Local Government Association’s resources board, said: “Some councils are facing a choice between using reserves to try and plug funding gaps or further cutting back local services in order to balance the books.”

Northamptonshire topped the BBC’s list (-91% of reserves), followed by Somerset (-73%), Rotherham (-62%), Thurrock (-58%), Croydon (-55%), Stoke-on-Trent (-55%), Sutton (-46%), Isles of Scilly (-46%), Knowsley (-44%), Greenwich (-44%) and Medway (-44%).

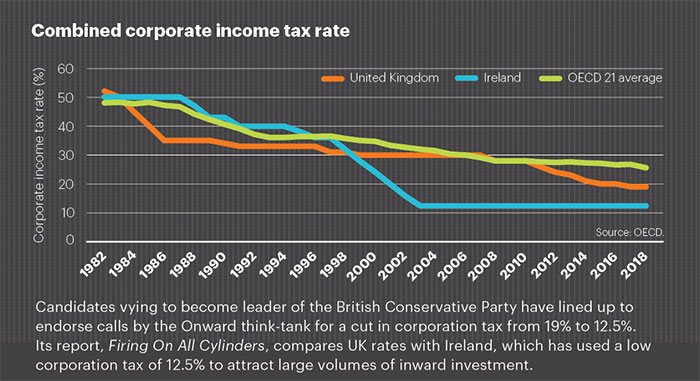

Cut UK corporation tax, say party hopefuls