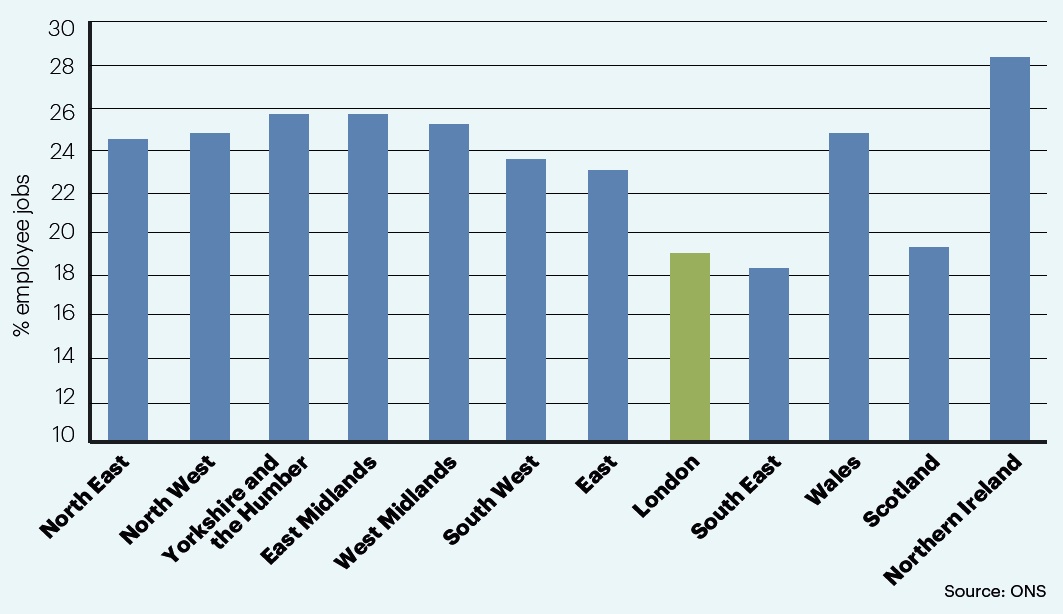

Living wage woes

Employee jobs paid less than the living wage, 2014

Northern Ireland has the highest proportion of low-paid jobs of any UK region. Employment data for 2014 shows that 29% of pay packets in the province contained less than the living wage.

Figures for London, the South East and Scotland were slightly better, with around 19% of workers paid below the benchmark. With London accounting for so much of the UK’s commercial activity, it is no surprise that it had the highest number of low-paid jobs – 752,000 paying below the living wage, compared with 214,000 in Northern Ireland.

Low-paid work has become more prevalent. Between 2008 and 2010, 13% of jobs in London paid below the living wage but this rose by six percentage points over the following four years. Nationally, this rose from 21% to 23% between 2012 and 2014.

Women are substantially more likely to be paid a low wage, with a 6 percentage point gender gap in London widening to 11 percentage points across the rest of the UK.

Few people will be surprised that the private sector accounts for the majority of the 5.9 million jobs in the UK that pay below the living wage. The commercial sector sweeps up five million of those posts, while the public sector accounts for 525,000 and the not-for-profit sector 355,000, according to Office for National Statistics data for 2014.

As a proportion of overall headcount, the private sector again is more likely to pay below the living wage, with the proportion outside London standing at just under 30% and 24% within the capital. The public sector is the least likely to pay poverty wages, with 9% of jobs outside London and 6% inside paying below the living wage.

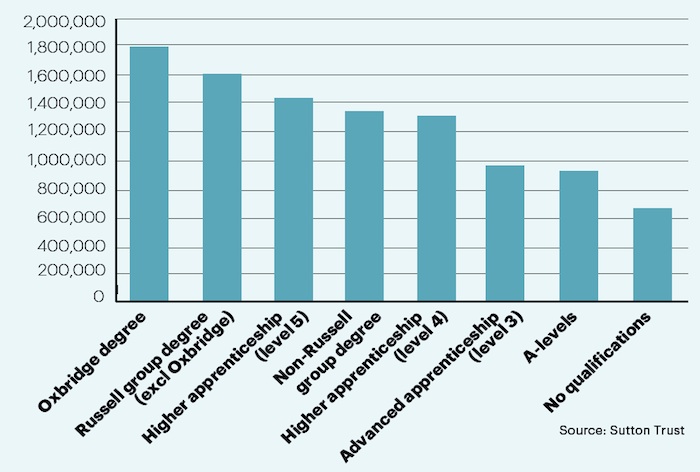

Gravy training

Average lifetime earnings by qualification

Unsurprisingly, lifetime earnings are strongly influenced by the highest level of qualification achieved.

Perhaps less guessable is that when student debts are included in the picture, most graduates are expected to earn less over the duration of their career than people who have completed a level 5 apprenticeship.

According to a study prepared by social mobility foundation the Sutton Trust, apprentices at this level can expect a greater cumulative income than all other groups except Oxbridge and Russell Group graduates.

Level 4 apprentices, meanwhile, can anticipate earnings roughly on a par with graduates from less exalted universities.

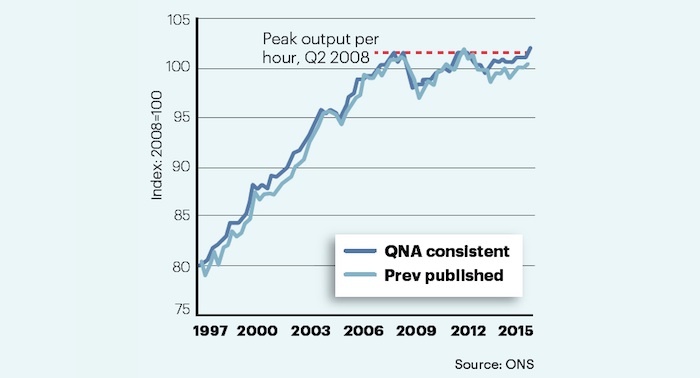

Productivity puzzle

UK output per hour, seasonally adjusted

Productivity improvement leads to economic growth, which in turn influences national deficit and debt, and hence dictates the severity of the Conservative government’s austerity policy. So the latest estimates of average output per hour, published by the Office for National Statistics, are in some ways encouraging and in other ways distinctly not.

Revisions to the latest Quarterly National Accounts show UK productivity crept above its pre-downturn level for the first time in the second quarter of this year, growing by 0.9% in the quarter to reach a new high. The previous peak was in 2008’s second quarter.

On the other hand, the trend since the downturn looks stubbornly horizontal compared to the pre-crash climb – illustrating the UK’s so-called productivity puzzle. Theories to explain the current doldrums include everything from errors in measuring output to the notion that sustained low interest rates are propping up inefficient working practices.

Brexit or border control

Brexit breakdown

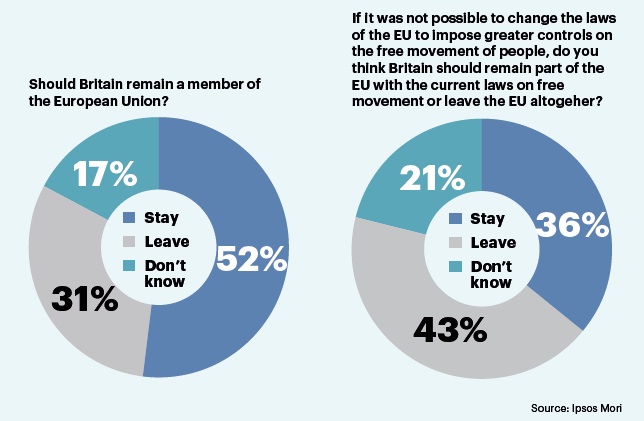

Asked a straight in-out question about whether the UK should quit the European Union, just over half of British people say they are in favour of staying put, according to polling company Ipsos Mori. Fewer than a third want to break away from Europe, with 17% undecided.

However, according to the company’s deeper questioning, the balance is tipped in the EU’s favour by the belief that the UK will be able to negotiate ways to toughen up border controls. Given a scenario where it is impossible to constrain the movement of migrants, a much greater proportion of Britons (43%) favour Brexit.

According to the poll, 58% of people in the UK think there should be greater controls on the movement of people between EU member states, while only 5% would like to see no curbs whatsoever on free movement within the union.

Pensions prudence

New rules giving access to pension pots have not led to the rash of short-sighted spending sprees that some observers feared.

A study by YouGov has found that only around one in six (16%) of people eligible to withdraw money from their pension pot has done so. The money released has not, in the main, been splashed out on sports cars or short-term enjoyment.

Among those who have released cash, about 18% admitted to spending it on a nice holiday, but an equal number chose to pay off debts, while another 13% used the money to reduce or pay off mortgages. A significant 37% ploughed the money they released into savings or investments.

Just over a quarter (26%) have drawn out cash to meet day-to-day expenditure.