By Jonathan Portes | 30 October 2013

There are signs of recovery all around, from GDP growth figures to rising house prices. So has the chancellor, as he claims, won the austerity debate, or is short-termism and poor policy-making threatening to undermine growth? Discuss

As the chancellor prepares to deliver his Autumn Statement on December 4, there is no doubt that the UK’s short-term economic prospects are considerably brighter than they appeared only a few months ago. The same commentators who at that time were speculating that we were doomed to perpetual economic stagnation and never-ending austerity are now hailing the feel-good factor of yet another UK housing boom.

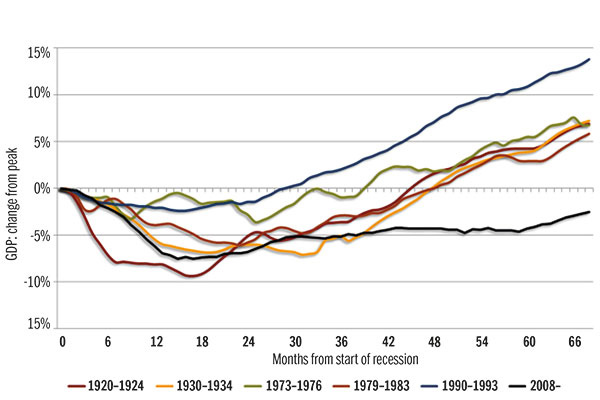

Meanwhile, now that it has finally materialised, even economists (including those here at the National Institute of Economic and Social Research) who have been saying for many years that an upturn is about six months away have been surprised by its apparent strength. But, in assessing where we are now, it’s important to remember the scale of the past few years’ underperformance. Despite recent growth, this remains the weakest

recovery in recorded UK economic history.

In June 2010, just after the incoming government’s ‘emergency Budget’, the Office for Budget Responsibility predicted that by now, the economy would be about 7% larger. This growth would be driven by a sharp rise in business investment and exports, while the deficit would have fallen by two-thirds. In fact, GDP has grown at less than a third of that rate, business investment has fallen and the path of deficit reduction bears no resemblance at all to the original projections (which is, as I’ll elaborate below, a good thing).

So, what has happened? Briefly, growth was derailed by a combination of bad luck and bad macroeconomic policy, both in the UK and in the eurozone. Fiscal policy was tightened too quickly; in particular, the very large cuts in public sector capital investment are now almost universally recognised as a major policy error. Moreover, while policy was supposed to boost confidence, and hence spur private sector investment to fill the gap, business was understandably reluctant to invest in a climate of uncertainty about demand, both domestically and internationally.

Given all of this, why recovery now? Actually, it is due to a number of factors that are reversing these trends.

First, the damage to growth from the front-loaded cuts to the deficit has now worked through, so some growth now simply reflects a natural bounce-back.

And the pace of fiscal consolidation has slowed. Since the lack of growth led to the government borrowing far more than it had originally planned – indeed, far more than the plans of the previous government, a level that the Treasury claimed would have led to panic in the gilts market – the government was faced with a choice: either abandon its fiscal framework – particularly the target that debt, as a proportion of GDP, should be falling by 2015/16 – or make further cuts and do further unnecessary damage.

To their credit, they decided to stop digging. As the OBR puts it, ‘deficit reduction appears to have paused’. So the fiscal squeeze has been relaxed, at least temporarily, while a number of government schemes are boosting the housing market (more on this later).

nign than a year ago: the eurozone crisis is on hold, and the US economy has been recovering for some time. This, in turn, has boosted business confidence, and meant that financing conditions have improved. Poor policy and bad luck have delayed recovery, relative to our original forecasts and everyone else’s, but it has not removed the UK economy’s ability to generate growth.

Paradoxically, then, the underperformance of the recent past means that, in the short term, the potential for rapid expansion exists. Many firms still have plenty of spare capacity.

Unemployment and underemployment are still very high. There is no sign of wage inflation, and with the Bank of England’s new governor, Mark Carney, pledging to keep interest rates at zero until unemployment falls significantly, interest rates will not be going up any time soon. Nor would fast growth now be anything to celebrate, over a medium-term perspective – we could grow at an annual rate of 3% for the next two years at least, and we’d still be poorer than we were in 2008.

Meanwhile, the political parties seem to be competing with each other over who can produce the most economically illiterate, and/or wasteful, approach to public policy in the short term. At least the evidence suggests that providing free school meals to young children will have some wider benefits, although it is very unlikely to be the best way to spend the money.

By contrast, pilot workfare projects in the UK have so far noticeably failed to improve employment outcomes, so spending an extra £300m on a national scheme now is an appallingly irresponsible way to spend taxpayers’ money. Meanwhile, although capping fuel bills is not a Marxist approach to the energy market, it is certainly a stupid and potentially counterproductive one. And the less said about the marriage tax-sweetener, the better.

But the booby prize has to go to the ‘Help to Buy’ scheme, which has so far achieved the near-impossible: close to unanimity among economists across the ideological spectrum, from the free-market Right to those with much more interventionist views, who all agree that it is one of the most ill-conceived policies to be implemented in the UK in recent decades.

The chancellor frequently says, ‘you can’t cure a crisis caused by debt with more debt’. Apparently, this only applies to direct government borrowing to build schools, roads and hospitals – not to off-balance-sheet financing to shore up the banks.

Nor does it appear to apply to encouraging home buyers to take on levels of personal debt that may prove unsustainable when interest rates do eventually rise. Unfortunately, rather than tackling today’s economic problems, all of this risks simply sowing the seeds of tomorrow’s crisis.

There are well-known market failures in both the retail and wholesale markets for mortgages, so there’s plenty of scope for radical reform. But instead of explaining what problem it is trying to solve and how, the Treasury has created yet another subsidy for banks. The main impact on the housing market will be to push up demand and therefore prices, resulting in further distortions in an already distorted market. It will neither build any new houses nor make existing ones more ‘affordable’ in any meaningful sense.

That does not mean we are yet in ‘bubble’ territory, at least not in the short term. The problem is not so much that house prices are reaching unsustainable levels, but that policy – by boosting demand without doing enough to increase supply – will ensure that prices remain high and rising for some time to come.

This has many damaging economic and social consequences – importantly, it reduces labour mobility, and redistributes wealth from the young, poor and the North to richer, older people in the South.

So, while house price rises will help support growth in the short term, it is hardly a sensible basis for a sustainable recovery, and is hardly consistent with the government’s commendable objective of economic ‘rebalancing’.

But looking beyond the immediate challenge of repairing the damage done over the past few years, the chancellor is entirely correct when he says that ‘the only sustainable way to raise living standards is to raise productivity’.

In fact, prior to the crisis, the UK did quite well on this score. Over the past two decades – up to and including the recession – GDP per capita grew faster in the UK than in all our major comparator economies.

Nor was it an unsustainable boom; while a small part of this reflected the growth of the financial sector – some of it illusory – the vast majority was due to a more skilled workforce and a more competitive economy, because of improvements in the UK labour market. And none of these factors has gone away.

So, we need both to build on some of the successes of the past 30 years – which were real – and address those areas where we have underperformed.

A medium-term growth strategy needs to reorient the UK economy towards equitable long-term growth that is less reliant on the financial sector, and more oriented towards investment and exports.

I see three key challenges.

First, young people. The UK has seen remarkably successful results from investing in and expanding higher education over the past three decades, which shows this was a sound investment policy as it has led to greater productivity and prosperity, as indicated by recent NIESR research for the Department for Business. But a large proportion of young people who don’t go on to higher education will end up without skills that are useful in today’s labour market – let alone that of the future, as the recent OECD report on adult skills has shown. That means insecure and temporary employment with few prospects at best, and a prolonged period with no job at worst.

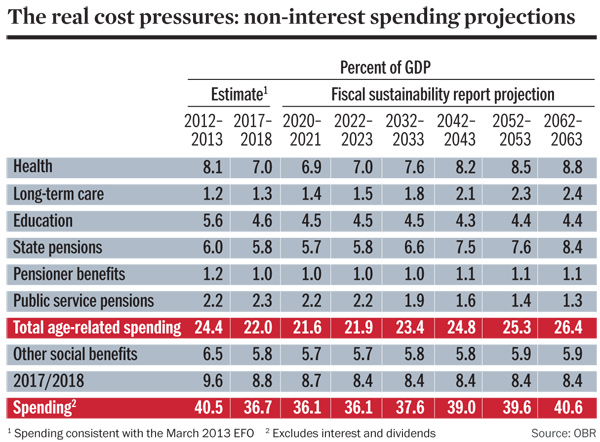

What can we do about this? We need to improve schools, as has been done successfully in London; ease the school-to-work transition; and address youth unemployment. Doing all of this might also help ease the pressure for even more restrictionist immigration policies, which the evidence suggests will do little or nothing to improve job prospects for young people, and may also reduce economic dynamism and productivity growth across the board Second, the welfare state. While the public remains committed to high-quality public services provided largely free at point of use, it also remains reluctant to pay the taxes necessary to fund them. This contradiction will intensify over time, as the OBR’s recent Fiscal sustainability report showed.

From a macroeconomic perspective, the chancellor’s recent commitment to running a budget surplus in 2020 and thereafter is entirely sensible. It reflects the sound (and very Keynesian) principle that government should aim for debt reduction when the economy is on track in order to provide the necesssary ‘fiscal space’ to cope with the inevitable expansion of deficits and need for fiscal stimulus in occasional downturns.

But the idea that this can be delivered just by cutting benefits to the undeserving (that is, working-age) poor, and further squeezing public services, is not sound. The OBR’s table shows where the real cost pressures will arise – in pensions, health and social care.

How can we square this circle? One way or another, better-off older people – especially those who benefited from the long house-price boom – need to pay more. There are lots of ways this could be done – for example, higher property or inheritance taxes, or charges for services, all payable only after death – but we need to end the expectation among relatively well-off people that they are entitled both to depend on publicly financed services in their old age and to leave their houses to their children.

Third, short-termism. The UK faces a pervasive problem of short-termism in both the public and private sectors. In the public sector, this is manifested, paradoxically, in doing some things much too quickly, and others much too slowly. We vacillate over the expansion of aviation capacity in the South East and the formulation of a sensible regulatory framework for energy. But on the other hand, we rush to implement major, untested reforms of public services like education and health without proper piloting or evaluation. In both cases, these reflect incentives on politicians to secure headlines for implementing their pet policies while avoiding alienating powerful interest groups.

Meanwhile, in the private sector, we have far too many businesses that are unwilling or unable to invest, whether in physical or human capital. A credible strategy would be to set out a coherent long-term vision for the UK: a high-skill, high-productivity economy, with structurally higher levels of investment, and a reasoned, patient strategy for getting us there that could survive changes of government.

Sadly, few of the policies on offer at present – whether capping utility or rail prices, or trying to boost house prices – take us any closer to this vision.

Jonathan Portes is the director of the National Institute of Economic and Social Research and former chief economist at the Cabinet Office

This feature was first published in the November edition of Public Finance magazine