Dan Corry

I have been lucky enough to have been involved in drafting Budgets.

I have helped politicians respond to them, and I have done a lot of writing about them.

I am used to flowery language, overclaiming, confusing the punters by mixing up real with cash amounts, single years with multiple years, and leaving them trying to work out what was new and what was a clever re-announcement.

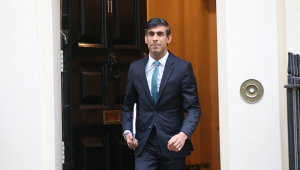

But I was pretty flabbergasted by one aspect of UK chancellor Rishi Sunak’s speech in his October Budget and Spending Review.

Sunak spent most of his speech telling us that the floodgates of public spending had now opened.

Suddenly, there was money everywhere.

Austerity was not only over but had a stake driven through its heart.

To top it all, the chancellor proudly made clear that – for the first time in ages – all departments would get a real-terms increase in their budgets (if one believes the inflation figures, of course).

But then, in spite of everything he had just said, Sunak told the House of Commons and the nation that he wants to bring down taxes; that he is really a small-state Conservative.

He is a clever man.

He must have known that the Institute for Fiscal Studies and others would quickly find he would be increasing tax to the highest level since the early 1950s; that far from shrinking the size of the state, he was raising it to the highest level since the late 1970s.

Sunak did not choose to keep spending very tight to bring down the debt and reverse some of the earlier tax rises.

Instead, he counted the extra money raised and chose to spend a good chunk of that too.

So what was going on? One theory is that Sunak did not really want much of his own Budget to be there.

Rather, it was his big spending, hi-viz-jacket-loving neighbour, the prime minister, who forced it all on him.

Maybe.

But that would make him sound truly powerless – not a good look for any chancellor.

Perhaps more likely is that he – along with other small tax, small state advocates – does not really know how to deal with the way the world is going.

As our population gets older, we are seeing health, pensions and care gobbling up more and more of what the state feels it can afford to spend.

This has been obvious for years and much written about in various specialist reports, but it is perhaps only now biting – partly brought into focus on the back of the Covid-19 crisis.

For some years, the answer was to cut everything else – including welfare, criminal justice and local government.

But that could not go on forever.

People were starting to notice.

Add to this the Conservative voter coalition that emerged from the 2019 election – they cannot afford private health or private schools.

They do not have three cars and nannies.

They do use welfare, at least sometimes.

This creates an issue about what to cut if you choose not to put taxes up.

So, Sunak is confused.

The Treasury is probably confused.

The opposition will have to work out what its lines are.

We could be moving into a new economic era.

Perhaps the new economic debates will be much less about tax and more about how we get better growth and productivity in this post-Brexit era.

Perhaps future elections will be a contest of what we spend public money on and how we do that well – not just the amount.

Maybe we will we see Brand Rishi’s signature on that sometime soon?