Ever since the 2008 financial crash, a sustained howl of anguish has emanated from local government about resources.

So it is perhaps surprising to find some councils saying: “We are perfectly OK, thank you – we do not need extra money.”

That is the message from the estimated 40% of English councils set to opt for less than the fullest permitted council tax increase in the coming financial year.

In 2021-22, councils can increase the domestic rate to 2% without holding a referendum – plus a further 3% for authorities providing adult social care.

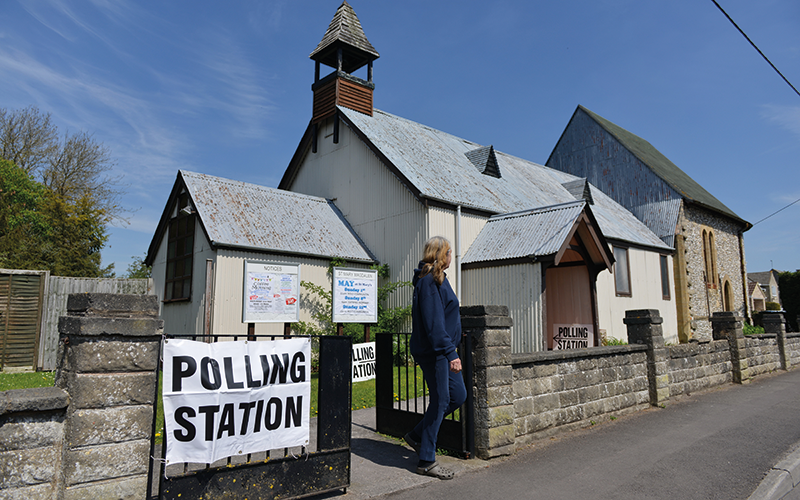

However, elections tend to concentrate councillors’ minds.

A bumper crop of May elections after delayed polls last year means many will avoid imposing extra costs on residents.

Adrian Jenkins, chief analyst at local government advisory firm Pixel Financial Management, says: “There is a tension between officers, who I suspect would like to increase council tax by the full amount, and members, who may have made promises about freezing council tax, or raising it by less than the full amount.”

Councils can defer the 3% social care precept for a year, although there is no guarantee it will be available beyond that.

Jenkins estimates that the restraint over council tax rises will see overall core spending increase by some 2.5% in 2021-22, rather than the 4.6% cited by the government.

One authority not imposing the full increase is Derbyshire County Council.

The Conservative administration had planned a third year’s freeze, but the impact of Covid-19 meant it needed extra resources.

Finance director Peter Handford says: “We have a 2.5% increase – 1.5% on the ‘normal’ council tax and 1% for adult social care.

"We could have gone to 5%, but the adult social care precept can be taken over two years, and we expect to take it next year. We are missing 0.5% on the ‘normal’ council tax.

"That is £1.6m-£1.7m, so not insignificant on a £50m-£60m budget, but not a dealbreaker.”

Handford says the pandemic has made it impossible to achieve some planned savings and brought extra costs – notably in looked-after children – but “there is nothing specific that we will need to cut or not do as a result of limiting the council tax increase”.

Meanwhile, Basildon Borough Council expects to freeze its tax. Leader Gavin Callaghan says: “It is not fair or right to ask residents to make up for the shortfalls in our lost income caused by the Covid-19 pandemic.

"Instead, we are working to commercialise more of our services and reduce spending in areas of the council where we can work more efficiently.”

The perennially low-charging London Borough of Wandsworth also plans a freeze, which leader Ravi Govindia calls “the single most effective thing we can do to help the largest number of people”.

In an unusual move, Wandsworth will create a charitable trust to take donations from wealthier residents wishing to help those less well off.

This year’s strange circumstances will see some councils giving away money rather than seeking it.

Jenkins thinks councils can live with the lost revenue income in the short term, but are storing up problems for the future.

“If you do not increase council tax by the full amount, you can never catch up. Your future increase is always 2% of something less, and that adds up over time,” he says. “There is no mechanism for a council to say ‘our predecessors made choices to keep council tax low, but we do not like

that and now want to catch up’.”

Tony Travers, professor of government at the London School of Economics, warns that councils “should be careful about the message they send – the idea that they have enough money will be heard loud and clear by the Treasury”.