Once you cut through the jargon, last week’s government study of staff retention rates within the public sector — Is staff retention an issue within the public sector? — doesn’t exactly make for great reading. All the more so if you work within a public sector senior management or HR role.

The conclusion is that while public sector workers are still marginally more likely to stay in their jobs (or a similar occupation) than people working in the private sector, they are less likely to do so today than they were in the past. In short, public sector staff are becoming less loyal to their employers.

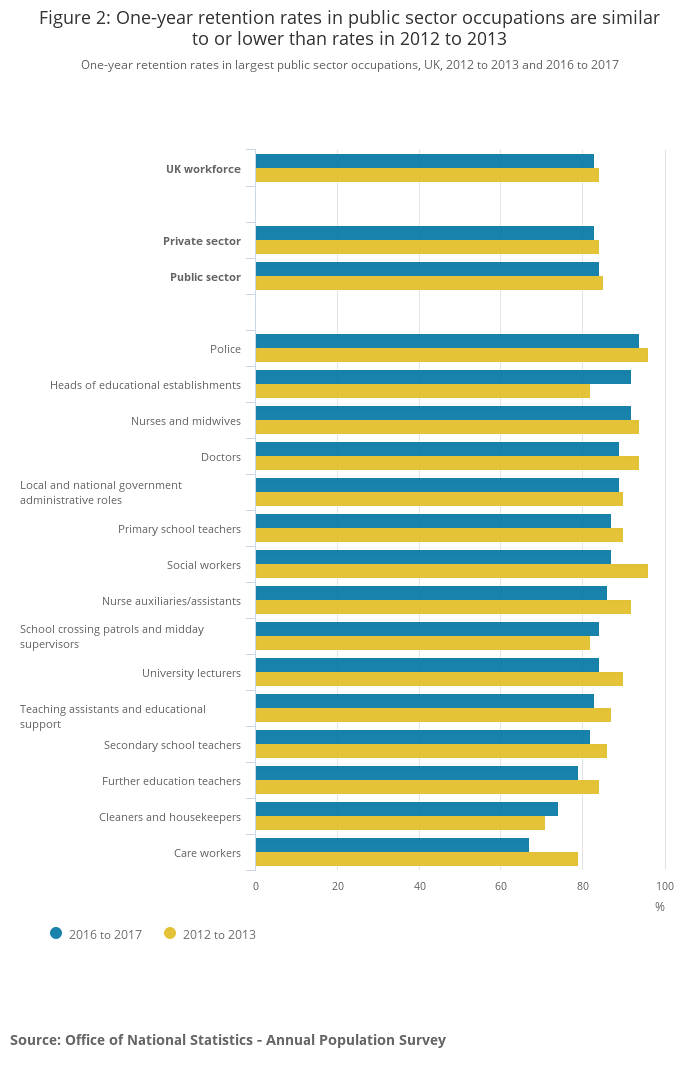

Commenting on the study, Anna Bodey of the Office for National Statistics, which compiled the research, said: “One-year retention rates in the public sector were lower in 2016 to 2017 than they were in 2012 to 2013, with the biggest fall in rate for social workers and public sector care workers.”

A full breakdown of the public sector occupations analysed can be seen in the chart, bottom. The sharp decline in one-year retention rates among care workers is a particular cause for concern, with more care workers being contracted to the private sector a likely driver.

Boosting retention rates

Now all employers, private and public sector alike, know that staff retention is crucial to success. On that front the ONS rightly observes in its study that ‘when people move on, employers can lose knowledge, experience and institutional memory’; but also that ‘recruiting and training new people costs time and money’, which has a material impact on efficiencies and overall results.

So how can public sector employers boost retention rates? Endless articles, essays and academic tomes have been written on the issue of staff retention, but certain factors stand out time and again. They include:

- Involving all staff in certain decisions being made so that they are engaged and feel they have a voice

- Offering flexible working practices where possible, such as the chance to work different hours or even work remotely

- Regular one-on-one check-ins with employees to get their feedback

- Anonymous surveys so that staff can really say what they think about their employers without fear of reprisals

- Ensuring all staff, at whatever level, are continually being challenged and feel they are progressing, e.g. through internal or external training

- Remunerating all staff fairly – paying what you can get away with will almost always be counter-productive

- Placing real importance on your employees’ well-being and ensuring they have regular opportunities to genuinely ‘leave work behind’

Financial wellbeing and retention

As the co-founder of a not-for-profit aiming to improve the financial well-being of consumers, another key way to boost retention rates is to offer staff, especially lower paid staff, financial support where necessary. This is especially the case within the public sector, as the NHS is the top UK employer of people who take out payday loans.

Public sector clients of Wagestream - one of our founding members, an ‘income streaming’ app, that helps public sector employees avoid the need to turn to ultra-high cost forms of credit, such as payday loans - include Hackney Council and the company’s analysis of the impact of income streaming on its clients to date shows that helping employees avoid high cost forms of credit creates a 10% improvement in staff retention rates. It also results in a 20% increase in overtime, as people work more in the knowledge that they can access their earned income much sooner.

So when you focus on ways to improve staff retention, in addition to the softer strategies listed above, consider harder tools that can materially support public sector employees in the often challenging financial world in which they live.

Helping staff feel more secure financially, and putting them back in control of their finances, is a benefit they will think long and hard about giving up.