The past decade has not been kind to local authorities and their balance sheets.

It began with a financial crisis that led to tangible pain for their portfolios, transmuted into a crushing austerity drive, even as yields plumbed new depths turning cash from a risk-free to a return-free asset, before ending up with even more uncertainty as we imagine what Britain post-Brexit might look like.

As to the future, as political processes go, Brexit must truly be one of the most shambolic in recent years.

A combination of misguided political ‘astuteness’, lack of coordination and little consultation has led to the UK undertaking a negotiation where no one actually knows what our position is.

While there is something to be said for holding cards close to one’s chest, the rules still require you to know in your own mind what your hand is, what you are seeking and what you are willing to sacrifice to win.

Unfortunately, the UK establishment appears to have retreated from these basic tenets with conflicting messages, open disagreements and complete lack of consensus. Other than the fact we might be leaving. Maybe.

These are not simply shades of political leaning. Rather, these are important contours that set the future macroeconomic and investment landscape that our balance sheets will inhabit and need to navigate.

Instead, we are unfortunately left grappling with uncertainty, that larger and scarier cousin of risk. The danger for many local authorities is that they become paralysed in the absence of clear direction and shrink their horizons down to immediate concerns and priorities.

That is dangerous. Regardless of the murkiness of tomorrow, we need to think carefully about what next and how best to plan.

’As political processes go, Brexit must truly be one of the most shambolic in recent years.’

The short answer to ‘What next?’ is that no one knows. To call rates, yields, projected asset returns, the future of Brexit, world trade, central bank behaviour, and so on with any certainty, requires either omniscience or blinkered bravado.

But lack of visibility does not mean we cannot analyse and plan. One may not be able to forecast the future, but we can identify the risks and opportunities that lie out there. Doing so is critical if we are to proactively manage balance sheets, safeguard them against emerging risks and eke out returns alongside.

The key task today is appreciating the corrosive impact of inflation on local government balance sheets and managing them holistically.

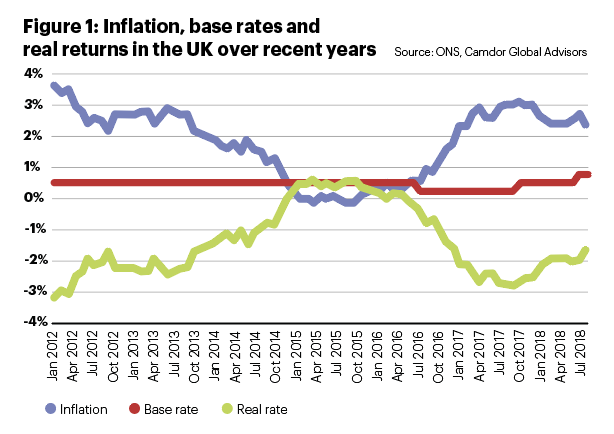

Local authorities – across both treasury and pension pools – are often focused on nominal returns, when what actually matters is the return over time once adjusted for inflation. Today, they are losing -1.65% annually if they hold cash. That is also the drag their investment portfolios must overcome before they can deliver returns that retain the councils’ spending power tomorrow.

Since flirting with zero throughout 2015, UK consumer price inflation has accelerated and been above the Bank of England’s 2% target for over 18 months now. Brexit has played a clear role, as the fall in the value of the pound led to more expensive imports and contributed to inflation. But other pressures are also building, notably the growing anger across society at low or stagnant wages and the ennui of austerity.

In more normal times, the Bank of England might raise interest rates to compensate but that has not happened.

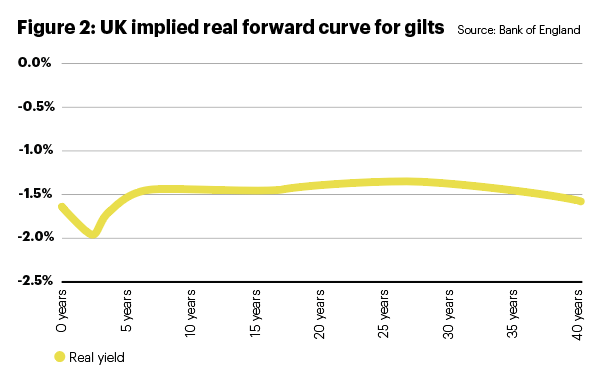

Economic uncertainty coupled with a fragile recovery and political deadlock has meant that the Old Lady’s focus is on minimising disruption tomorrow. Future expectations of the real yield curve – in other words, future yields after adjusting for inflation – are also gloomy.

For the next 40 years, the consensus is that investors will face a headwind of around - 1.5% per annum as they try to eke out returns. That means rethinking the portfolio to increase real yield, while being mindful of the enhanced risks that interest rate rises and volatility portend. A holistic perspective is doubly important given the diverse ways in which inflation attacks the local authority balance sheet.

⦁ Capital programmes: many councils face increased costs in the event of any rise in input inflation, more so if any of this has to be borrowed.

⦁ Pensions: LGPS liabilities are long duration and index-linked, increasing dramatically in an inflationary environment. Their assets will need to keep apace while councils may need to rethink funding plans that represent a long-term demand on revenues.

⦁ Asset returns: Treasury portfolios and other investment pools typically do not take inflation into account, focusing, in reality, on nominal returns and running negative returns.

⦁ Economic growth: growth risks will affect both revenue budgets and assumed investment returns.

⦁ Wages: other outcomes, eg wage inflation, could further impact the cost base of councils and their pension contributions.

But inflation is just one dimension of this complex landscape.

Brexit brings reduced investment into local economies as businesses and households plan around uncertainty.

Sterling is likely to become a far more volatile currency, trapped incessantly by the cut and thrust of free trade dialogues and sentiment. With that volatility comes added conservatism and increased costs of hedging for those businesses and investors with foreign inputs and holdings.

Outside Brexit, there are deeper concerns including the high levels of property and asset valuations, global tensions such as the incipient trade war between the US and China, rising populism across society, and scary levels of global debt – now running some 50% higher than when the last crisis began a decade ago.

But there are also opportunities.

Businesses still need to operate and to borrow. Local economies still need support and infrastructure.

There are assets that are secured or that can deliver returns in real terms. Doing nothing or hoping for the best is not an option nor an investment strategy. Brexit – regardless of the path taken – will lead to volatility in the pound, in interest rates, in inflation expectations and in financial markets.

Councils should use the current period to ‘health-check’ their portfolios, identify gaps and weaknesses, and examine mitigants where possible. If disaster strikes, they’ll be prepared and will even absorb the pain.

That is the prudent thing to do in today’s environment.

This is a farming game. Like the farmer tilling his fields year after year, we can alternately curse the gods and pray for clement weather.

But like the farmer born of experience, we can also watch the signs carefully and plan our crops accordingly, taking control where we can.

It does not always guarantee a good harvest but it certainly improves the odds over time.