image copyright iStock

The Local Government Pension Scheme has been going through a period of immense change in recent years, creating both opportunities and challenges.

The largest of these is the advent of the LGPS pools where assets are combined, but other examples include the increase in employers joining schemes and changes to the annual allowance.

One area facing change is talent management and staff resourcing, and the Pensions and Lifetime Savings Association (PLSA) undertook research into issues facing local authorities and how they are being addressed.

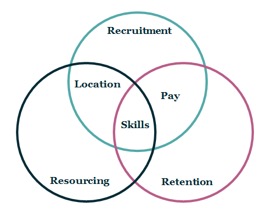

Through a snapshot analysis of funds, and in depth interviews with senior management, we found that the challenges faced by the LGPS overlap in three key areas – recruitment, resourcing and retention – which we refer to as the three ‘Rs’.

It will come as no surprise that pay is a good example of where the three Rs can overlap, as it is affected both by austerity and LGPS funds often finding themselves in competition with the private sector.

Low pay can cause difficulties, especially in the face of low public sector pay growth – and can result in recruiters forfeiting the best candidates.

Indeed, pensions are different to many other aspects of a local authority’s work, making it hard for HR departments to ‘price’ roles correctly, thereby impacting recruitment and retention.

Location is another factor that affects recruitment and resourcing. In many ways funds cannot win, being either too far from talent hubs (e.g. Manchester and London) or too close to other LGPS funds and pools, resulting in additional levels of competition for the talent available.

The third category that cuts across all three ‘Rs’ are the specialist skills needed to perform pensions roles, including pension and investment management expertise, regulatory knowledge and accountancy skills. Finding someone who ticks all the boxes can feel like a mammoth task.

Retention remains high within the LGPS, which is fantastic, although it can lead to issues further down the line.

For example, funds are currently losing senior managers with tremendous technical expertise and knowledge to retirement. At the same time, they are unable to replenish ranks at all levels quickly enough because it takes time to build up the relevant skills in junior staff that allow them to replace retiring colleagues.

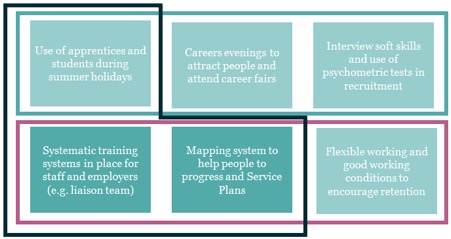

Our research revealed some innovative ways in which funds are approaching the three Rs, offering examples of best practice for the rest of the industry.

For example, the implementation of apprentice schemes and work experience has been used to help identify potential future workers. Students also benefit, developing skills and gaining a better understanding of the job options available in pensions.

Another method used is interviewing based on soft skills, not just technical ones. As candidates are unlikely to have the technical expertise required straight away, adding psychometric tests to the recruitment process can be helpful.

Training programmes can also be implemented to help ensure career development, along with a role-mapping system. This is created using the necessary soft skills for positions, allowing employees to understand what job they might like to progress towards. This system can also highlight where junior staff can shadow managers in order to develop new skills.

Best practice also includes allowing flexible working.

Flexibility opens jobs up to a wider range of candidates, while having the added benefit of helping to retain employees who might need to reassess their working hours due to factors such as caring responsibilities.

As the challenges facing LGPS overlap across the three Rs of resourcing, recruitment, and retention, it makes sense that solutions of best practice would also intersect. We demonstrate this through the diagram below.

As part of our research, we interviewed comparable private sector schemes that share characteristics with our LGPS members.

We found they often experienced many of the same issues, such as lower levels of basic pay than competitors.

However, our research identified a number of ways they have overcome this, such as offering wider benefits like healthcare; highlighting the company’s ethos in order to appeal to younger workers; and encouraging staff development and training.

Our research is the first step to providing an overview of the talent management and resourcing issues facing LGPS funds.

There are still areas where more work will be needed – it’s too soon to tell what the full impact of the LGPS pools will be on local authorities, for example – but what is clear is the need to create opportunities for progression and a more formalised career development process.

We will be working with our members to help monitor and tackle these issues and will release a guide on this topic later this summer.