The fiscal monitor, published this week, found that almost £1 trillion had been wiped off the wealth of the UK’s public sector since the financial crisis, putting it in the second weakest position of the 31 nations assessed. Only Portugal’s public finances were in a worse state.

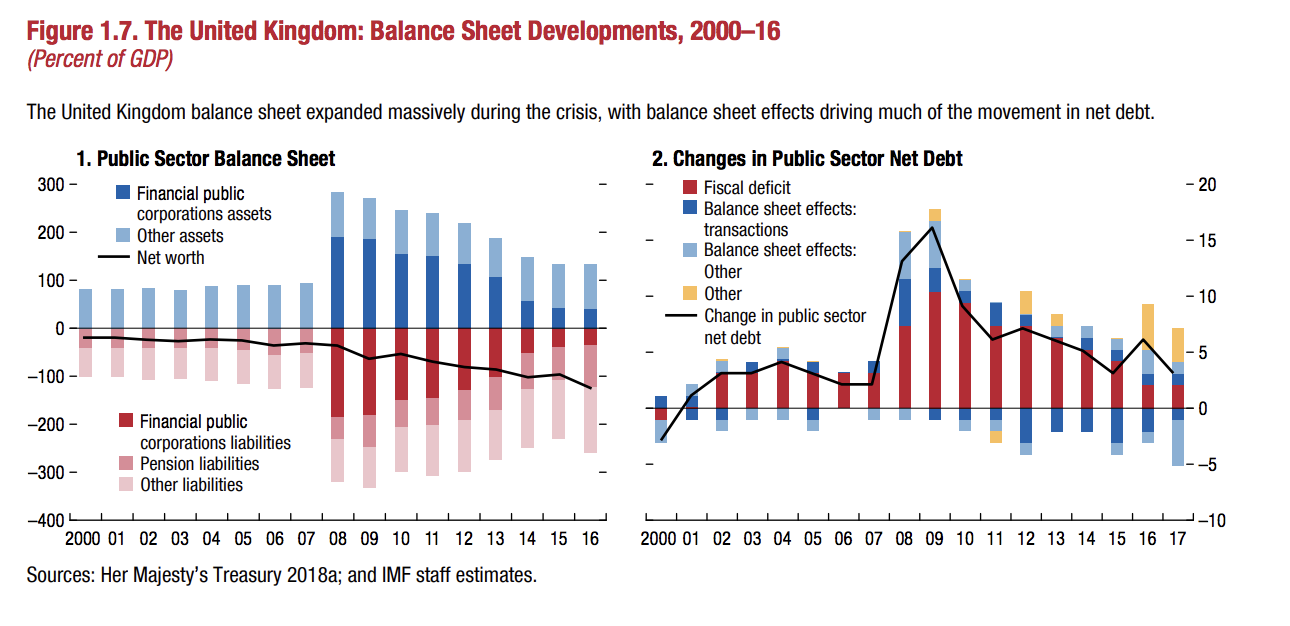

The decline is equivalent to 50 percentage points of GDP since 2008.

The IMF calculated that the bailout of UK banks, such as the £45.5bn injection of government cash into the Royal Bank of Scotland, and the growth of Britain’s public sector pension liabilities were significant factors in the UK’s ranking.

Since the crisis, this has racked up significant debts, despite the government’s austerity measures, it added.

Presenting the fiscal findings at the IMF and World Bank annual meetings in Bali yesterday, Vitor Gaspar, the director of IMF’s fiscal affairs department, said the UK government’s bail out of banks had lead to their reclassification as ‘public sector’.

“As a result, public sector liabilities increased by more than 200% of GDP between 2007 and 2009, from 126% of GDP to 335% of GDP.

“Assets also increased - public debt ratios increased because of the previously mentioned interventions but also because of reductions in output. On balance, there was a significant deterioration in public sector net worth,” he said.

The findings also revealed that the UK government has less than £3 trn in assets and £5 trn of liabilities, revealing a negative net worth of more than £2 trn.

This was attributed to the sell-off of public assets in the 1980s and 1990s by the then Conservative government.

The Washington-based lender assessed the assets and liabilities – the balance sheet - of the 31 countries - which cover 61% of global GDP, with the total assets worth $101 trillion, or 219% of GDP - rather than just looking at the countries’ debt and deficit.

It also considered the benefit of assets such as publicly owned corporations and natural resources.

Using this approach, countries such as Gambia, Uganda and Kenya rank above the UK because they have higher net wealth relative to GDP, despite their smaller assets and liabilities.

At the top of the rankings was Norway, with the most secure public finances because of its oil wealth. Russia, Kazakhstan and Australia followed in the rankings.

The IMF added that the UK government was continuing to explore ways to improve the management of its assets and balance sheets.

In a blog for the IMF, Gaspar said: “Over time, better accounting and statistical collections can improve the accuracy of these estimates. Governments can use them to do basic balance sheet risk and policy analysis, using the framework presented in this report.”

International public finance management consultant Manj Kalar said: “The IMF public sector balance sheet analysis report should be commended for shining a light on public sector assets and liabilities.

“Traditionally the focus has been on measuring public sector debt as a proportion of GDP.

“That’s not the whole picture. To get a complete picture you need to focus on assets too - to assess how to better manage assets, and achieve better public financial management.”