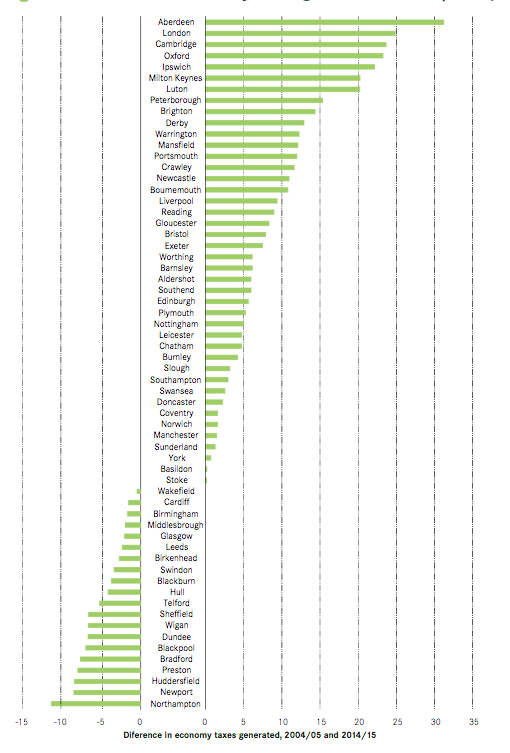

Think-tank Centre for Cities conducted a review of economy taxes – such as income tax, land and property taxes, and VAT, but excluding consumption taxes like alcohol and tobacco duty – raised from cities.

It found London contributed 28.6% of national tax take in 2014/15. This was up from 25.3% in 2004/05 and amounts to a £28bn increase in cash terms.

By contrast, the next four biggest city contributors to national tax take all saw their contributions fall in percentage terms.

Manchester contributed 3.3% of national economic tax take in 2014/15, down from 3.6% in 2004/05, while revenue from Birmingham fell from 3.4% to 3%. Meanwhile, Glasgow was down from 1.9% to 1.7%, and Leeds down from 1.4% to 1.2%.

Source: Centre for Cities

This is partly the consequence of the impact of the 2008 financial crisis and recession, which is still being felt across British cities, with more than three quarters generating less tax now than in their pre-recession peak.

However, such a heavy reliance on raising revenue from the capital creates potential risks to the public finances, Centre for Cities chief executive Alexandra Jones highlighted. Any slowdown in London’s economy following the vote to leave the European Union would therefore lead to major challenges.

“The UK’s growing reliance on London’s taxes underlines the importance of ensuring that the capital prospers in a post-Brexit world. But our research also shows that more must be done in the years ahead to strengthen the economies and tax bases of other city regions such as Greater Manchester, the West Midlands and the North East, many of which voted strongly for Leave,” she stated.

“Boosting productivity in both London and major UK city regions will be vital in helping the country as a whole to grow and prosper in the years ahead.”

The calculations of tax revenue are based on taxation that is dependent on growth of the economy, which account for 88% of all taxes raised in Britain.