EU predicts deep and uneven recession

EU predicts deep and uneven recession

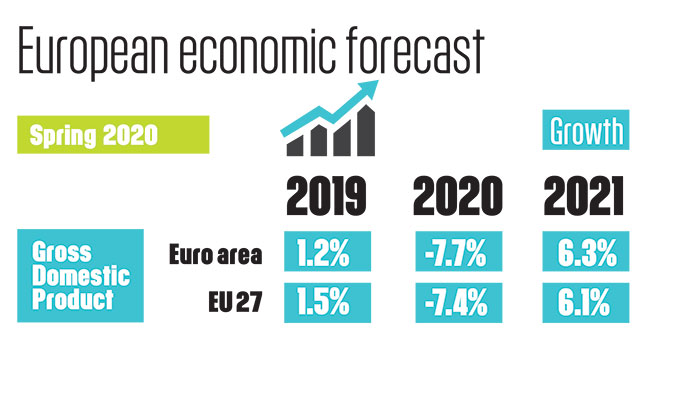

The EU economy will experience a recession of “historic proportions” this year, owing to the economic shutdown caused by Covid-19.

In its Spring 2020 Economic Forecast, the EU predicted that the euro area economy will contract by a record 7.75%, with the wider EU economy set to decrease by 7.25% in 2020. However, it said it expects the economy to bounce back next year, by 6.25% and 6% respectively.

Valdis Dombrovskis, the European Commission’s executive vice president for An Economy that Works for People, said: “At this stage, we can only tentatively map out the scale and gravity of the coronavirus shock to our economies. While the immediate fallout will be far more severe for the global economy than the [2008] financial crisis, the depth of the impact will depend on the evolution of the pandemic, our ability to safely restart economic activity and to rebound thereafter.”

The unemployment rate in the euro area is also forecast to rise from 7.5% in 2019 to 9.25% in 2020, before declining again to 8.25% in 2021. In the EU, the unemployment rate is forecast to rise from 6.7% in 2019 to 9% in 2020 and then fall to around 8% in 2021.

Covid-19 could drive half a million businesses to insolvency

Covid-19 could drive half a million businesses to insolvency

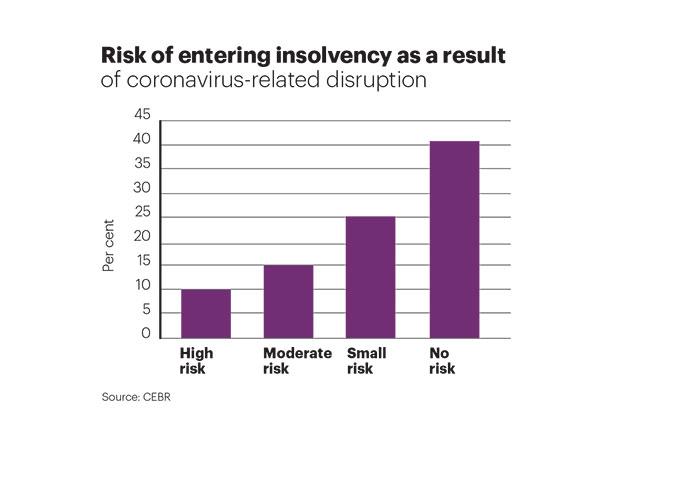

More than 500,000 businesses are at a higher risk of insolvency as a result of the economic downturn caused by the coronavirus pandemic, according to the Centre for Economics and Business Research.

A survey of 500 UK businesses carried out by CEBR found that 10% of respondents were at a high risk of insolvency as a result of the pandemic – equivalent to 590,000 companies.

A second wave of infections and a subsequent lockdown could prove “fatal” for the business community – as one million businesses may not survive a further three months of lockdown, CEBR said.

UK prospects ‘deeply uncertain’, NIESR

UK prospects ‘deeply uncertain’, NIESR

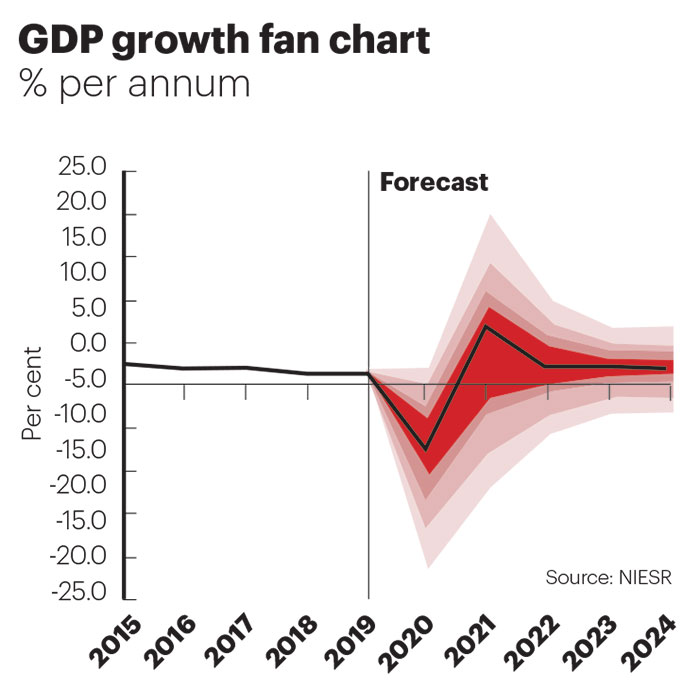

The economic outlook for the UK is “extremely uncertain” and is dependent on the effectiveness of policies to manage the economy and the spread of Covid-19, according to the National Institute of Economic Social Research.

In its twice-yearly report, the think-tank predicted that the economy could lose £800bn over the next decade. It also forecast that unemployment could rise to three million – 8.25% of the workforce – before falling back towards two million in 2021.

“The most significant challenges are likely to come when the lockdown is eased and supportive measures are withdrawn. Government schemes will then need to be adapted to prevent unnecessary business failures as the economy recovers,” the report said.

GDP is estimated to have dropped by 30% during lockdown, shrinking the economy by 7.5% this year.

Pandemic sees unprecedented decline in carbon emissions

Pandemic sees unprecedented decline in carbon emissions

Global demand for energy has dropped to a 70-year low amid the coronavirus crisis, resulting in a record annual decline in carbon emissions of almost 8%, according to the International Energy Agency.

The report projects that energy demand will fall 6% in 2020 – seven times higher than the drop that followed the 2008 financial crisis. This will be an “unprecedented” decline that is the equivalent of losing the entire energy demand of India, the world’s third largest energy consumer, the IEA said.

Advanced economies are expected to be worst hit, with demand set to fall by 9% in the US and by 11% in the European Union, the IEA added.

US treasury to borrow a record $3trn this quarter

US treasury to borrow a record $3trn this quarter

The US government said it plans to borrow a record $3trn in the three months to the end of June, to cover its coronavirus stimulus package.

The June quarter borrowing goal is six times higher than the previous three-month record of $530bn – which took place during the third quarter of 2008, following the global financial crisis. It’s also more than twice the amount borrowed in the whole of 2019.

The Congressional Budget Office said it expects the federal budget deficit to hit $3.7trn by the end of the 2020 financial year.

Coronavirus could increase youth unemployment by 600,000

The current economic crisis could push an additional 600,000 18- to 24-year-olds into unemployment in the coming year, with long-term damage to pay and job prospects unless major support is provided, according to think-tank the Resolution Foundation. Its research found that the employment rate for graduates entering the labour market three years from now is projected to be 13% lower than if the crisis had not hit.

Emergency funds for vulnerable people

The government allocated an additional £76m in funding last month to “help safeguard some of the most vulnerable people in society”. This includes survivors of domestic abuse and sexual violence, and vulnerable children and their families.

Nearly a quarter of employees furloughed

For the two-week period from 20 April to 3 May, 6.3 million employees were furloughed under the government’s job retention scheme by 800,000 businesses, according to statistics from HMRC. This is equivalent to almost a quarter of the employed UK workforce, and cost £8bn for that period.