One of the less anticipated announcements in July’s Budget was Chancellor George Osborne’s decision to increase the rate of Insurance Premium Tax (IPT) by more than half – from 6% to 9.5% with effect from 1 November 2015.

With insurers expected to pass this cost on, local authorities face an automatic rise in total insurance spending of 3.5%. This also means tax now represents almost one tenth of their insurance costs. So it is imperative that local authorities mitigate their expenditure on insurance while ensuring protection remains appropriate to their risk profile.

A key consideration is the structure of how you finance risk, in particular levels of self-insurance, via an insurance programme design review. This work should be completed by a qualified actuary and include advice on various levels of self-insurance and anticipated costs of external insurance (including tax) for each option. Conducting such an exercise will enable local authorities to ensure cover is purchased on the most efficient basis – and even if this work has been completed relatively recently a refresh may be required following the change in taxation.

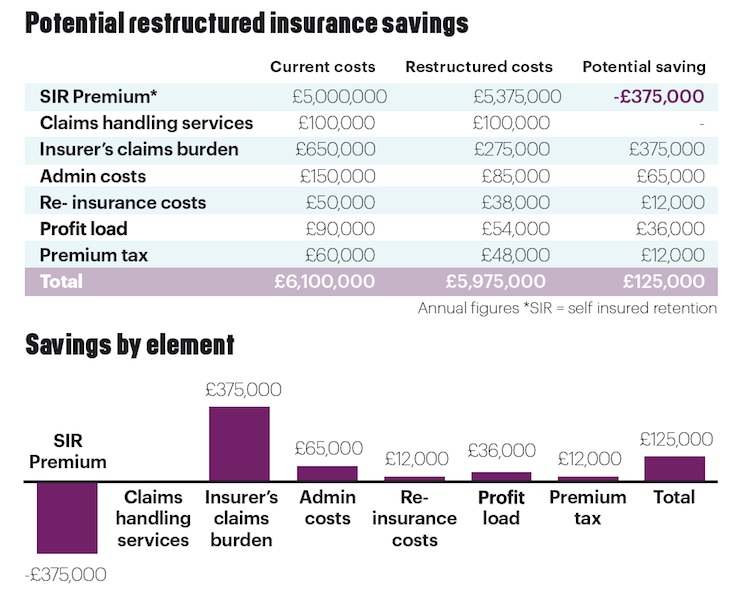

For example, the figures in the graphic (below) illustrate long-term savings that could potentially be achieved from taking a higher level of self-insured deductible (that portion of a loss for which the insured is responsible). The actual results achievable will vary significantly depending on the type of authority and the magnitude of the increase in deductible.

Over recent years there has been limited demand within local government for alternative risk financing solutions – such as mutuals or risk pools – with the London Authorities Mutual (LAML) the most recent.

However, the public sector push for devolution and closer working between local authorities may be a driver to consider how insurance cover and service teams could best be knitted together to achieve a more efficient solution.

Consequently, the time is ripe for local authorities to consider the options available and establish whether they offer a more efficient alternative to traditional insurance cover.

Aside from exploring alternative forms of risk transfer, local authorities must continue to demonstrate their risk profile in the most effective way, including:

● Property data reviews – such as the establishment of estimated maximum loss limits, which assist underwriters in assessing the total sums at risk.

● Natural catastrophe modelling, to help you understand the impact a flood would have and negotiate with insurers effectively.

● Reviews of claim reserves.

● Demonstration of proactive risk management work.

● Gap analysis to highlight both currently uninsured risks and policies that are unnecessary.

While this work would be conducted by a local authority’s risk and insurance personnel, the involvement of senior finance individuals will be particularly valuable when considering the nuances of public sector procurement regulations – as these can prove obstructive to generating wider competition from new insurance participants.