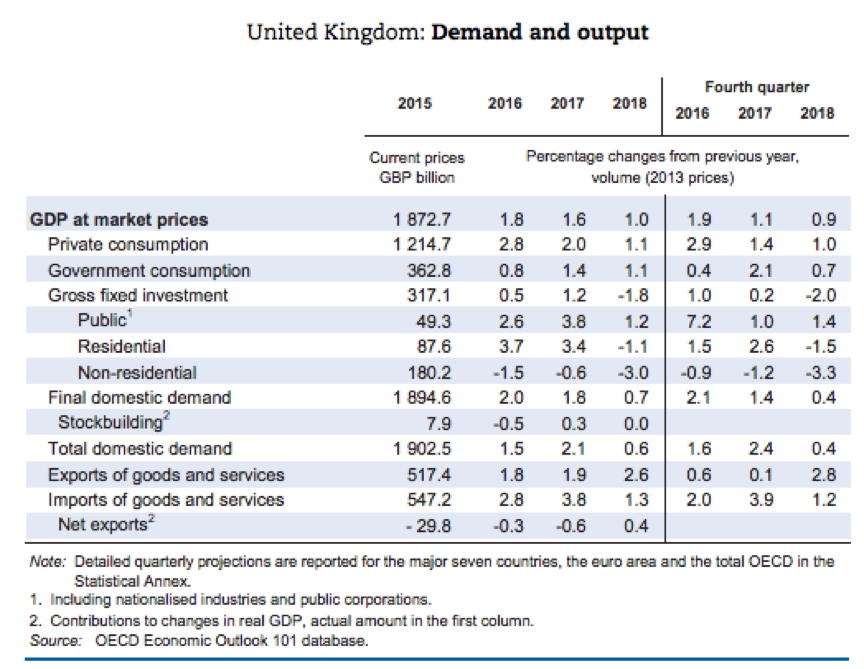

Researchers from the OECD believe UK GDP growth will grow 1.6% this year but will drop to 1% in 2018.

This is slightly lower than the World Bank prediction, which came out yesterday and forecast the UK economy would grow 1.7% this year.

The World Bank also said UK growth rate would slow from 1.8% in 2016, although upgraded its January forecast of 1.2% for 2017.

The Paris-based OECD outlined its growth forecasts in its bi-annual global economic outlook report today [see table below for UK figures].

Its forecast for the UK is in contrast to its projections for the world economy growing by 3.5% this year and 3.6% next year.

The report stated: “The [UK] economy is projected to slow in 2017 and 2018, owing to uncertainty about the outcome of the Brexit negotiations.

“This projection assumes that the United Kingdom's external trade will operate on a most favoured nation basis from April 2019.

“The uncertainty, and the assumed outcome, is projected to undermine spending, in particular investment.”

Despite policies to support private confidence and consumption, the OECD notes that household spending is expected to take a dip due to a weakening labour market and higher inflation reducing real wage growth.

The OECD also highlights that the UK has missed its inflation target of 2%, exceeding that aim, reflecting the recent exchange rate depreciation.

The report said the UK “faces a long-standing decline in its export market share”.

It warned that its less affluent regions, which mainly export manufacturing and agricultural products, are exposed to the risk of global protectionism, which could lower incomes and raise inequality.

Economists form the OECD called for regional and urban transport links to be enhanced to increase access to better technologies and lower export costs.

The report’s analysis of the UK concluded: “The major risk for the economy is the uncertainty surrounding the exit process from the European Union.

“Higher uncertainty could hamper domestic and foreign investment more than projected, but swift progress in negotiations and an outcome that retains strong trade linkages with the European Union would lead to better outcomes than projected.”

The World Bank’s analysis predicted the UK economy would slow to 1.5% in 2018.

John McDonnell, Labour’s shadow chancellor, described today's OECD report as a "hammer blow" to the Conservative's economic credibility adding that their "cliff-edge Brexit" will harm the country's economy.

He said: "The OECD’s calls for increased investment in our economy is a ringing endorsement of Labour's economic policy in this election, and shows the clear choice voters have on Thursday.

"It is between a Labour plan for serious investment in our economy, with a focus on living standards and a jobs-first plan for Brexit; or a Tory plan that would hold our nation back with continued cuts to vital public services and chronic under-investment.”

The Lib Dems have said the OECD report did not bode well for the Conservatives.

Lib Dem shadow chancellor, Vince Cable, said: "Voters should listen to this eve of poll warning on the major economic risk posed by Theresa May’s extreme, UKIP-style Brexit.

"The hardline approach Theresa May has taken, insisting that no deal is better than a bad deal and planning to take us out of the single market, will seriously damage jobs and the public finances for years to come."