Since the policy was announced in 2011, business rates retention has been framed as an opportunity for councils, one that enables those that ‘succeed in growing their local economy to get a direct boost to their income’.

Less attention has been drawn to the other side of this coin – providing a financial incentive to councils to grow their business rates revenues also means exposing them to the risk of seeing those revenues fall. It is this issue that we focus on in our latest piece of work.

We analyse the importance of the risks of divergences in funding between councils more broadly and find that the allocation of rates revenues between counties and districts is a crucial determinant of the extent of that risk.

If, as planned, the share of changes in business rates revenues retained by councils is increased from 50% to 75% by April 2020, the financial incentive to councils will increase and so, by definition, will the risks. The government may yet take the policy even further – the extension of 100% pilot schemes into new areas suggests it remains interested in 100% retention as an end goal.

Thus we look at what the extent of the risks to council funding might be under 100% retention. Because we don’t know how revenues and spending needs will evolve in future, we instead model councils’ incomes as if a system of 100% retention had been in place between 2006-07 and 2013-14.

In particular, we model a system based on scaling up the parameters of 50% retention – retaining the current split between districts and counties whereby 80% of locally retained business rates are allocated to districts and 20% to counties. What we find is that such a system could have resulted in significant divergences between councils in their ability to meet their spending needs.

However, digging down into the results of our modelling suggests one potential way to mitigate these effects. In fact, the divergence between councils would have been largely driven by substantial divergences between district councils. By contrast, there would have been very little divergence among counties.

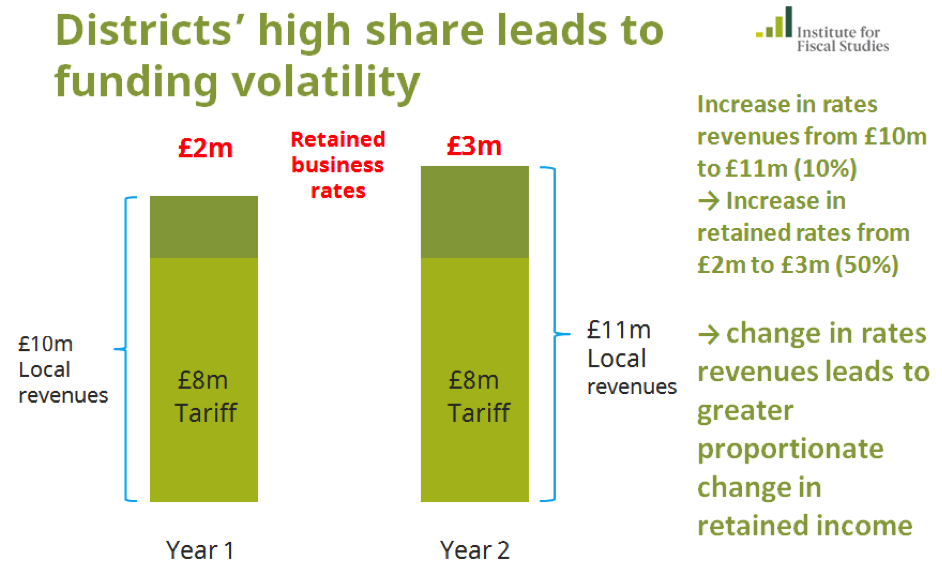

The reason for this pattern is the initial allocation of business rates revenues between districts and counties. Allocating 80% of business rates revenues to districts means that districts must bear the impact of 80% of any change in local business rates revenues, as opposed to the 20% borne by counties. Furthermore, because districts retain such a large proportion of locally raised revenues, they must all pay tariffs into the system. This vastly increases the impact on districts’ incomes of any changes in business rates revenues, as shown in the diagram below.

Shire districts’ high allocation of rates revenues and low spending needs mean they often pay large tariffs

The potential solution to funding divergence suggested by these results is to change the ratio of allocation between districts and counties. For example, if the ratio had been reversed such that 20% of local rates revenues were allocated to districts and 80% to counties, funding divergence among districts would have been significantly reduced without a substantial increase in divergences between counties.

This is because counties have larger and more diverse tax bases (including much higher revenues from council tax) and are thus more insulated against changes in their business rates revenues. An additional benefit of such a shift would be that counties, at least on average, would be protected from seeing their retained revenues fall relative to other councils (if business rates revenues were to grow in real terms as has historically been the case).

Presented in this light, changing the allocation of revenues between districts and counties seems like a no-brainer. However, as pointed out at the beginning of this post, risk of funding divergence and the provision of financial incentive go hand in hand. Reducing the risk of divergence among districts by reducing their share of local revenues would also substantially reduce their financial incentive to grow their revenues.

On the other hand, the corresponding increase in the share of local revenues allocated to counties would increase the incentive for counties to promote growth in their revenues.

Whether this shift in incentive makes sense depends on which tier of local government you think is most able to respond. Districts were initially allocated the larger share of local revenues because it was felt their control over most of the local planning system meant they were most likely to be able to directly influence local growth.

Either way, the decision of how to allocate business rates in two-tier areas comes back to the question at the very heart of local government funding – that of choosing how to balance risk and incentives.