The tax would raise an additional £1.6bn more per year across Great Britain compared to the current system, the IPPR said, in a paper released yesterday.

If a property tax of 0.5% on the actual present-day value of a home was levied it would also help even out wealth distribution across the country, the think-tank suggested.

Council tax in England is currently paid according to bands and using 1991 property values.

The IPPR said its tax proposal would “be far more progressive than council tax and would effectively capture increases in house price in a way in which the current system does not”.

It added: “The new tax we propose would therefore act as both a property tax and a tax on consumption”.

Over time the 0.5% percentage charged on a property would be increased, the think-tank suggested, which would allow the reduction of stamp duty land tax, which would eventually be phased out altogether.

The IPPR said that its “radical plan” would also help to ensure a more even distribution of wealth through the UK.

“The vast majority of households would benefit from the tax change, and for those in the bottom half of the income distribution, incomes would rise,” the report stated.

Currently, wealth is twice as unequally distributed as income, with the top 10% of households owning 44% of wealth while the bottom 50% own just 9%, the think-tank said.

Carys Roberts, senior economist at IPPR and co-author of the report, said: “The UK is a wealthy nation but that wealth is very unevenly distributed, which has negative implications for both economic prosperity and justice.”

The report also said that the new property tax would be levied on landlords and not directly on tenants.

Although it recognised this could end up being “passed on to tenants in the form of higher rents”, it said that along with the “simultaneous abolition of council tax – which is usually paid by the tenant – would help to ensure that the disposable income of tenant households was not negatively affected”.

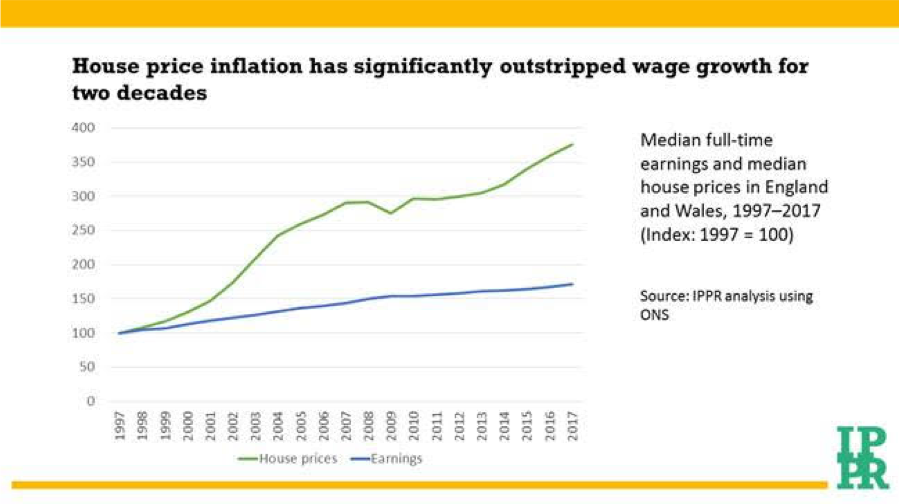

The report pointed out that since 1997 average house prices have increased four times faster than average full-time earnings [see below]. The IPPR would dampen future house price inflation, the think-tank suggested.

Roberts called the current system of council tax “regressive” and “outdated” and suggested IPPR’s proposals would “effectively capture increases in house prices in a way that the current system does not.”

The IPPR said that currently housing is undertaxed relative to other assets, distorting investment behaviour and contributing to growing wealth inequality between homeowners and non-homeowners.

It also said that the current system failed to yield all the revenue possible for public services due to avoidance.

A Liberal Democrat report previously suggested replacing the current business rates system with a land value tax.

Read Lib Dem peer Chris Fox’s blog for PF on his party’s proposal.