Quick wins

Libraries shelved: councils cut spending on libraries by £25m in 2015-16, continuing a five-year downward trend, according to CIPFA. The institute’s annual survey of public libraries also revealed that the number of visits fell by 15 million compared to the previous year.

India takes away: two banknotes that accounted for 86% of the currency in use in India were suddenly pulled out of circulation in November. The 500 and 1,000 rupee notes were banned to tackle corruption but the rapid move disrupted the country’s cash-driven economy.

A struggle to pass the exam: only six areas in England come close to meeting the criteria for more grammar schools, Education Policy Institute analysis has found. It said this would make it difficult to identify new sites without putting pupils who fail to win a place at a disadvantage.

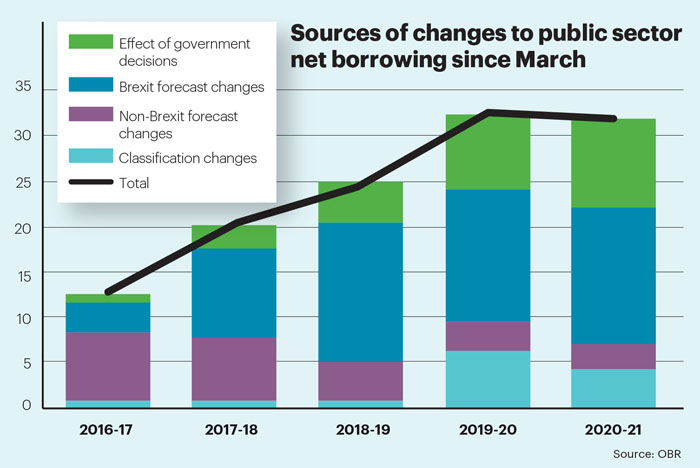

Brexit costs to build up

Costs to the government of exiting the EU are likely to build over time and require a substantial additional net borrowing, the Office for Budget Responsibility said in its Economic and Fiscal Outlook released alongside the Autumn Statement. In 2018-19, for example, Brexit is expected to account for more than £15bn of the £25bn change to borrowing predicted for that year and to incur £59bn in extra borrowing in the next five years.

The OBR’s Autumn Statement forecasts also said Brexit was likely to knock 2.4% off economic growth over the next five years. The OBR noted that the government had provided it with little information as to the nature of Brexit. It said: “Given this and the considerable uncertainty surrounding the economic and fiscal implications of different outcomes, we have not attempted to predict the end point of the negotiations.”

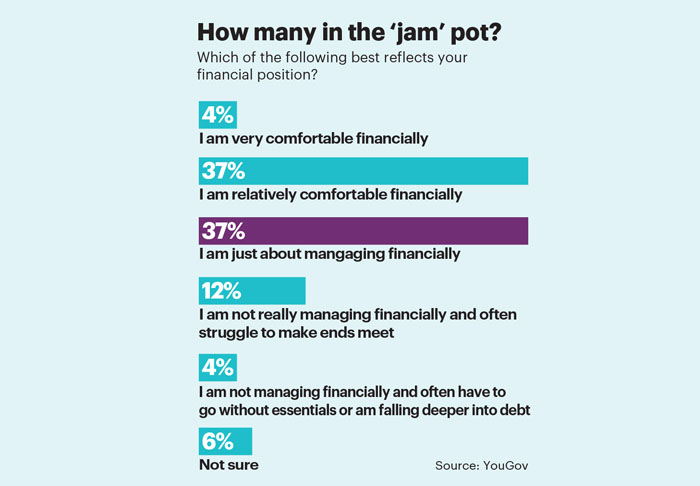

Spread thin

Almost one in four of us believe we are only just about managing financially. Ahead of the Autumn Statement, there was much talk about the so-called “jams” – a struggling group the government says it is keen to help.

A YouGov survey carried out just after the statement found that 37% of people put themselves in the jam pot – equivalent to around 18.5 million Britons and double the Resolution Foundation think-tank’s estimate. An equivalent proportion said they were relatively comfortable, but 16% reported more severe financial hardship.

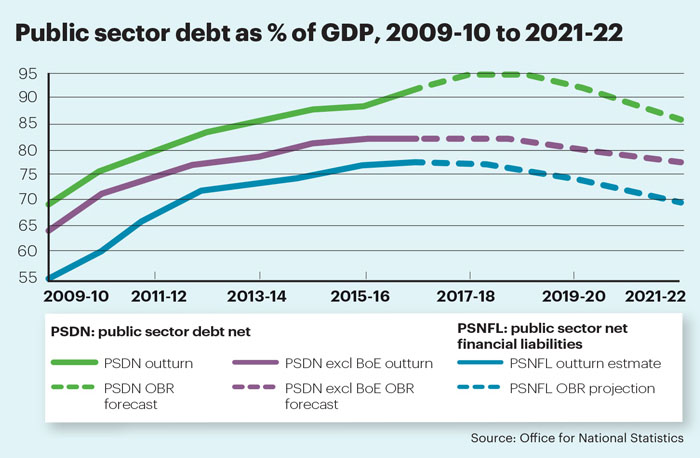

Debt eats more GDP

Public sector debt is likely to hit 90% of GDP in the next financial year.

This proportion has been increasing steadily since 2009-10, defying one of former chancellor George Osborne’s fiscal rules that debt should be falling as a percentage of GDP.

According to predictions in the Autumn Statement document, debt will start to fall from 2018-19.

Chancellor Philip Hammond was required to recast his predecessor’s fiscal rules, shunting them into the next parliament. He confirmed that the government would no longer seek to deliver a surplus in 2019-20.

The generation gain

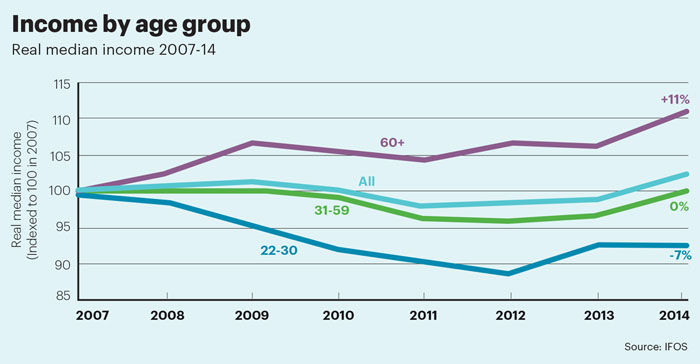

Some stark generational inequalities have been highlighted by the Institute for Fiscal Studies’ regular analysis of Autumn Statement data. While the over-60s have enjoyed an 11% boost to their real incomes since the 2007 downturn, those aged 22-30 – the so-called millennials – have suffered a 7% real cut to their incomes. Those aged between 31 and 59 have found themselves back where they started in 2007, seeing zero income growth following a fall that halted only in 2012.

IFS director Paul Johnson said it had been the worst decade for living standards since the Second World War, if not the 1920s. “We have seen no increase in average incomes so far and it does not look like we are going to get much of an increase over the next four or five years either,” he said.

Not that bothered

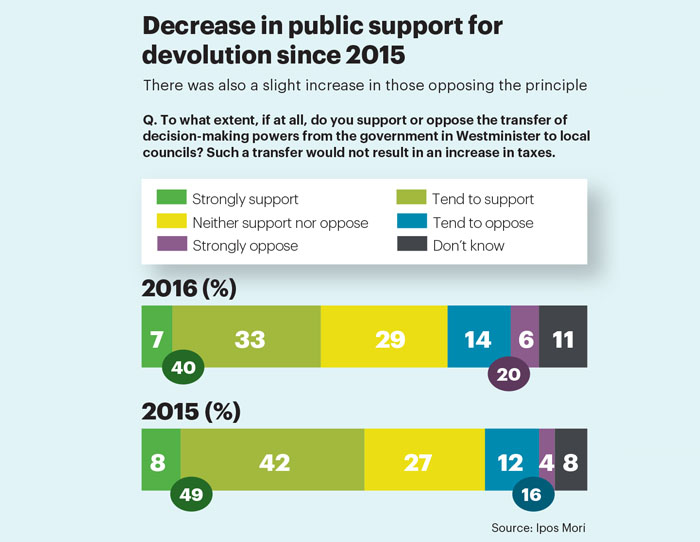

Public support for devolution has started to flag, according to Ipsos Mori research. Passing more power and control down to cities and regions is one of the key ways the government hopes to reshape and revitalise public services as they endure years of austerity.

However, while 40% say they either strongly support or tend to support the devolution drive in 2016, this is down from almost half who said this in 2015.

At the other end of the scale, opposition to devolution is up from 16% in 2015 who said they tend to oppose or strongly oppose it to 20% last year. e proportion expressing no opinion has remained broadly consistent.

Big bucks for Buck House

Buckingham Palace is to undergo a major 10-year refit expected to cost £369m. The works, due to begin in April, will modernise the 17th century building; its boilers, electrics, pipes and cabling have barely been updated since the 1950s. The refit will also increase energy efficiency, improve disabled access and create a visitor admissions area, so opening times can be extended.

The works will make the palace fit for purpose for the next 50 years, a royal trustees’ report said. The costs, while significant, are expected to deliver £3.4m through savings and from a rise in income from, for example, events, tours and being able to open for longer. Funds will come from a temporary rise in the sovereign grant, from 15% to 25% of Crown Estate profits.

Sir Alan Reid, keeper of the privy purse, said: “This investment will help preserve a landmark building for future generations. We firmly believe that our chosen option offers the best value for money and reduces the risk of a more costly, catastrophic building failure in the years to come.”