Public accounts are the cornerstone of fiscal transparency, while also ensuring governments achieve maximum value from their holdings of assets and liabilities.

So it should not be surprising that such accounts have a long history, tracing back over 15,000 years to Mesopotamia.

In Athens, around the fifth and fourth centuries BCE, public accounts were often set in stone and public officials were subject to an audit by ten accountants at the end of their term in office – an ancient equivalent of the select committee.

While fiscal transparency standards have changed, accounting saw a true innovation in 1494, in Venice, when Luca Pacioli, made the first written record of double-entry book-keeping in his work Summa di Arithmetica.

Several governments across Western Europe soon adopted double-entry book-keeping.

The UK though was a late joiner, not adopting it until the 1830s.

It was the concerns of taxpayers, rather than accounting technology, which drove the gradual improvement in our fiscal transparency.

It wasn’t until the 1850s that there was information on government spending and revenue.

The 1860s saw the establishment of the Public Accounts Committee, which also oversaw the work of the Comptroller and Auditor General (C&AG), who is charged with auditing the accounts of government.

To this day, the Committee continues to be assisted by the C&AG who is a permanent witness at its hearings.

At recent hearings, the Public Accounts Committee have welcomed improvements in the public sector which have seen the UK take the lead globally in fiscal transparency.

The Whole of Government Accounts (WGA), which reports the financial position of the UK public sector, consolidates the audited accounts of over 6,000 organisations and is the only set of consolidated public sector accounts in the world that includes both central and local government.

However, the committee has recommended that the Treasury make better use of WGA to both improve public financial management and inform policy.

The Treasury agreed with this recommendation, and so last year devoted more resource to support this endeavour, including by setting up a new balance sheet Analysis unit.

The work of the unit has already seen the publication of guidance in July to improve the management and scrutiny of contingent liabilities.

The unit has also undertaken analysis of the public sector balance sheet to understand its expansion since the financial crisis.

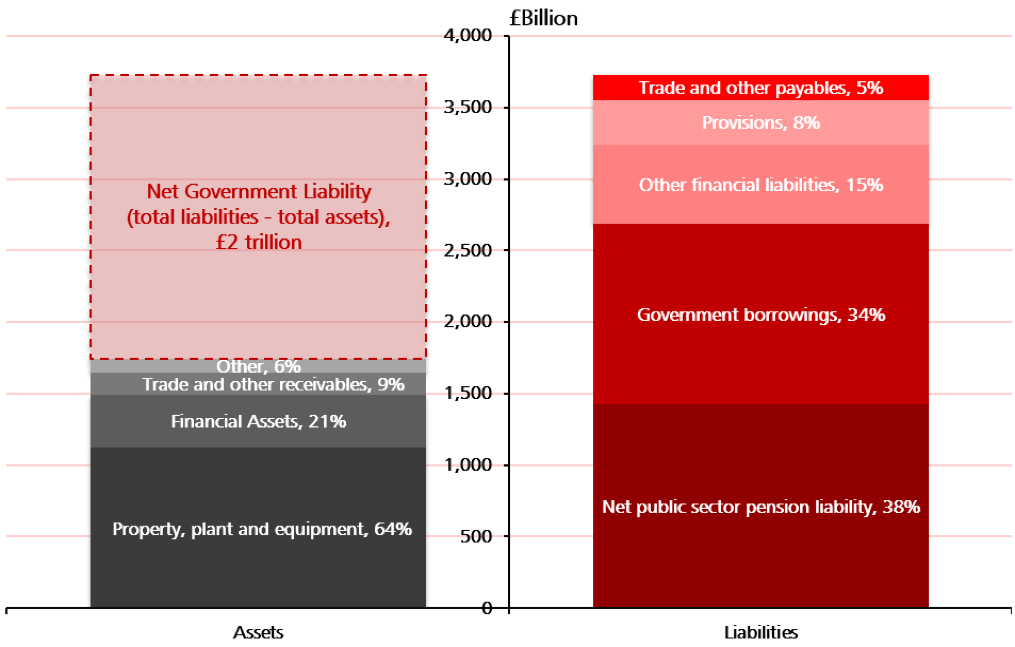

WGA shows that the UK’s net liability position (liabilities minus assets) has grown from 80% of GDP in 2011-12 to over 100% in 2015-16, which amounts to £1.7trn of assets and £3.7trn of liabilities (see figure 1).

Given the scale of public sector assets and liabilities, and the fact that the Treasury has now set up internal structures to support work on the balance sheet, the time is ripe for a comprehensive balance sheet review.

This is why the government formally launched the review at the recent Autumn Budget.

The review will not only support the sustainability of the public finances but also help release resources for further investment in public services.

The Treasury will work closely with other government departments in carrying out the review to improve balance sheet management by, for example, looking at ways to pool investments to minimise the cost of multiple management fees or making money out of government’s ideas, by selling some intangible assets like software.

The review has already been welcomed by international organisations as well as the Public Accounts Committee.

The government has committed to providing an update at Budget 2018 – we believe that the balance sheet review is an asset with the potential for significant return.