The Department for Work and Pensions yesterday published its review into the state pension age.

Announcing the plans, secretary for work and pensions David Gauke said the new proposed timetable for the rise would “maintain fairness between generations” in line with continuing increases in life expectancy.

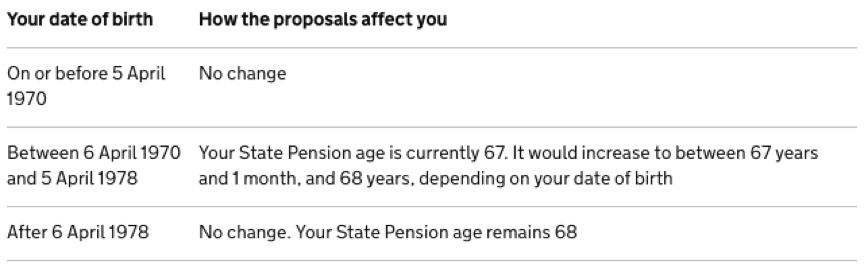

Under current proposals the rise was due between 2044 and 2046 but if the government goes ahead with its new plan it could be changed between 2037 and 2039.

Gauke said: “Since 1948 the state pension has been an important part of society, providing financial security to all in later life.

“As life expectancy continues to rise and the number of people in receipt of state pension increases, we need to ensure that we have a fair and sustainable system that is reflective of modern life and protected for future generations.”

Gauke said when the state pension was introduced in 1948, a 65-year-old could expect to spend 13.5 years in receipt of it – around 23% of their adult life.

This has been increasing ever since. Now in 2017, a 65-year-old can now expect to live for another 22.8 years, or 33.6% of their adult life.

The government cited analysis from the Office for National Statistics, which stated this demographic pressure will increase by a third, rising from 12.4 million pensioners to 16.9 million by 2042.

According to the DWP keeping the state pension age at 66 would cost over £250bn more than the government’s preferred timetable by 2045/46.

However, Debbie Abrahams, shadow work and pensions secretary, told MPs the proposal was “anything but fair”.

She said the inequalities of old-age health between different UK regions, sexes and ethnic groups meant the government’s plan was “astonishing”.

Labour’s manifesto for the 2017 general election promised not to raise the state pension age above 66 years of age without their own review, which would be tasked with developing a flexible retirement policy to reflect both the contributions made by people, the wide variations in life expectancy and the arduous conditions of some work.

Frances O’Grady, TUC general secretary, warned that hiking the pension age could lead to people enduring the status of “second-class citizens”.

She echoed the concerns of Abrahams because disparities between different parts of the country would mean the state pension age will be higher than healthy life expectancy.

“Low-paid workers at risk of insecurity in their working lives will now face greater insecurity in old age too,” she said.

Adding: “Rather than hiking the pension age, the government must do more for older workers who want to keep working and paying taxes.”